Highlights

The US real estate market continues to attract international investors due to its economic stability, legal certainty and potential for real estate appreciation. For many foreigners, buying property in the US represents not only a financial investment, but also an opportunity to establish residency or generate passive income through short- and long-term rentals.

Diversification of the real estate portfolio is one of the main factors that lead foreigners to invest in the country. The market offers options for different buyer profiles, from those looking for vacation homes in Florida to investors purchasing properties in large urban centers such as New York and Los Angeles for long-term rentals. In addition, financing programs and tax incentives specifically for foreigners make investing even more accessible.

The price medium of the properties acquired was US$ 780.300, 19.8% higher compared to the previous year. This is the highest figure ever recorded by the NAR, driven by the general increase in real estate prices in the US and the buying profile of international investors, who tend to purchase properties in higher-value areas.

Florida, Texas and California continue to be the most sought-after states, while buyers from Canada, China, Mexico and India are leading the transactions. In addition, cash payment continues to be the main form of purchase among international investors.

Contents

HideThe United States remains one of the most desirable markets for global real estate investments due to its economic stability, legal predictability and wide range of opportunities. The country has a safe regulatory environment for foreign investors, guaranteeing asset protection and predictability in transactions. In addition, the constant appreciation of real estate in various regions attracts buyers looking for security and long-term profitability.

Another determining factor is the diversity of the market. From luxury properties in New York and Los Angeles to affordable real estate in southern states and the Midwest, there are options for different investor profiles. Growing demand for vacation rentals and high liquidity market conditions make investing in real estate an attractive alternative for those seeking financial diversification and passive income. In addition, many foreign investors use US real estate as part of an internationalization strategy.

Florida, in particular, stands out as the most sought-after state for international buyers. With its tropical climate, absence of state income tax and consolidated tourist infrastructure, the state attracts investors looking for both property appreciation and short- and long-term rental opportunities. Cities such as Miami, Orlando and Tampa lead the way, making them ideal destinations for those wishing to purchase vacation properties or vacation rental investments.

In addition, Florida is home to a large community of foreigners, especially Latin Americans and Canadians, which makes the adaptation process easier for international buyers. Air connectivity with different parts of the world, the diversity of leisure options and the continuous growth of the local real estate market make the state one of the most solid for investments in the sector.

The US real estate market continues to be one of the safest and most profitable options for international investors. The appreciation of the dollar against other currencies has been a positive factor for those who have already invested in the country, as real estate purchased in previous years has appreciated significantly against investors' local currencies. What's more, the strong dollar makes the American real estate market an excellent asset protection tool against currency fluctuations.

Dollarizing investments is a strategy increasingly adopted by foreigners seeking to diversify your assets and ensure greater financial predictability. The US real estate market, known for its liquidity and long-term appreciation, is one of the best vehicles for this strategy. In addition, the legal certainty and transparency of the sector reinforce investor confidence, making the US a consolidated destination for those who wish to keep part of their assets in hard currency.

Expectations for 2025 are even more encouraging. Experts in the financial sector are predicting a possible drop in interest rates, which would make real estate credit more accessible to foreigners interested in financing their purchases. As a result, demand for real estate is expected to increase and, consequently, the market will rise again. This projection also reinforces the idea that this is an excellent time to invest, taking advantage of the conditions before a possible rise in prices.

In addition, there are signs that the dollar may weaken slightly against other currencies over the course of 2025, as the Federal Reserve's monetary policies are adjusted. This possible devaluation could open up new opportunities for foreign investors, making American real estate more affordable and increasing the return on investment in the long term. With a positive scenario ahead, the US real estate market remains a smart choice for those looking for solidity and asset growth.

International buyers can be divided into two groups:

- Non-resident foreignersThose who have a permanent residence outside the USA.

- Foreign residents: New immigrants or temporary visa holders living in the USA.

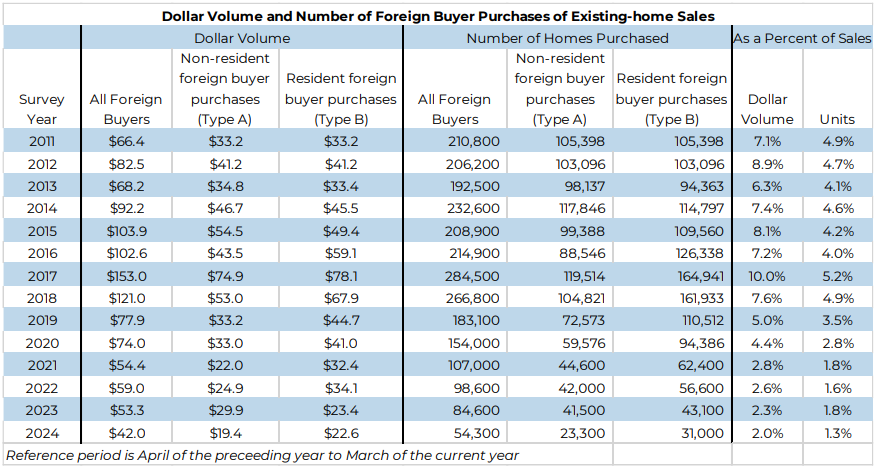

The distinction between these groups is important because it directly influences the type of purchase and the method of financing. Foreigners residents in the USA bought US$ 22.6 billion in real estate, while the non-residents invested US$ 19.4 billion. While residents tend to seek primary housing and have greater access to bank financing, non-residents often buy properties for vacation rentals or investment, using cash payment.

The greater share of residents in the total volume of purchases reflects a growing trend in immigration to the US, as well as the desire to establish permanent residence in the country, taking advantage of employment and education opportunities.

Between April 2023 and March 2024, international buyers purchased 54,300 existing propertiesThis represents a slight drop compared to the previous period. This reduction is linked to global economic challenges and the lower supply of available properties.

Foreign buyers are attracted by the stability of the American real estate market, by real estate appreciation and the opportunities to obtain passive income with rentals. The south of the USA continues to be the most sought-after region due to the favorable climate and the supply of vacation rental properties.

International buyers play a significant role in the US real estate market, bringing in foreign capital and contributing to the dynamism of the sector. The diversity of investors reflects the attractiveness of the American market for different profiles, from those seeking financial security to those wanting a second home for leisure or study.

The reasons that lead foreigners to invest in real estate in the USA vary according to nationality, but some common factors include the stability of the American economy, the appreciation of real estate and the possibility of generating passive income through rentals. What's more, the US legal system offers protection to investors, guaranteeing security in transactions and transparency in contracts.

International real estate buyers in the United States come from different backgrounds, each with different motivations and behaviors.

-

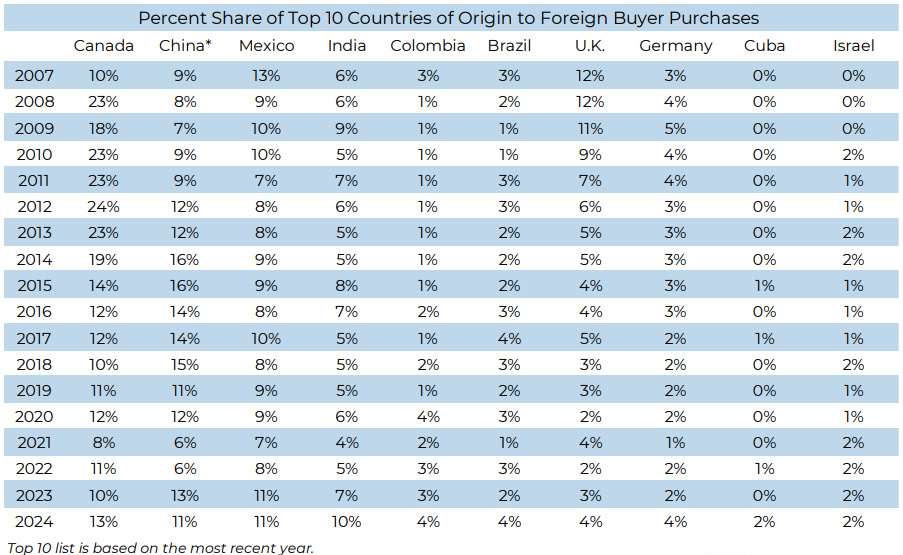

CanadaRepresenting 13% of international purchases, Canadians are attracted by the geographical proximity and milder climate of states such as Florida. Many seek homes to escape the harsh Canadian winters, purchasing properties for seasonal use or retirement.

-

ChinaWith 11% of acquisitions, Chinese investors see the US as an opportunity for asset diversification and security. In addition, there is significant interest in real estate close to renowned educational institutions, with a view to educating their children.

-

MexicoAlso with 11%, Mexicans are influenced by cultural and geographical proximity. Many are looking for real estate to establish a second home or for investments that facilitate frequent travel between the two countries.

-

IndiaWith 10% of purchases, Indians are showing growing interest, driven by an expanding middle class and the search for educational and professional opportunities in the US.

-

ColombiaRepresenting 4% of purchases, Colombians seek economic stability and security, often purchasing real estate in states such as Florida, which has a significant Latino community.

Position and Trends of Brazilian Investors

Between April 2021 and March 2022, Brazilians invested approximately US$ 1.6 billion in real estate in the USA, representing 3% of international sales and positioning Brazil in fifth place among the main foreign buyers

Recent data indicates that between April 2023 and March 2024, Brazilians invested approximately US$ 2.1 billion in real estate in the United States, representing, once again, 3% international sales and placing Brazil sixth among the main foreign buyers

This interest is motivated by the search for diversification of investments, protection against domestic economic volatility and opportunities for real estate appreciation.

The trend indicates an increase in the number of Brazilian investors in the American real estate market. Factors such as economic instability in Brazil, the desire to dollarize and the search for quality of life have encouraged this movement.

States like Florida are particularly attractive due to their similar climate and the presence of established Brazilian communities.

In short, the US real estate market continues to attract a diverse base of international investors, each with specific motivations. For Brazilians, in addition to economic factors, cultural aspects and the search for property security play crucial roles in the decision to invest in American property.

International buyers in Florida

Florida continues to be the most sought-after state for foreign buyers, attracting a constant flow of international investors. Among the top countries buying real estate in Florida are Brazil stands out next to Canada, Argentina, Colombia, Venezuela and the United Kingdom. The strong presence of Brazilians in the state is due to the search for diversification of assets, financial security and investment opportunities in the short- and long-term rental market.

A air connectivitywelcoming culture and tourist infrastructure make Florida an ideal destination for foreign investors. Miami and Orlandoin particular, concentrate a large part of the purchases, especially of real estate aimed at vacation and vacation rentals. Many international buyers choose Florida as a second home or as part of an investment dollarization strategy, taking advantage of the long-term appreciation potential of real estate.

The decision on where to invest in the US real estate market varies according to the profile and objectives of the international buyer. Some are looking for permanent housing, while others prioritize short-term rental properties or long-term appreciation. In addition, factors such as climate, taxes, job opportunities and proximity to urban centers directly influence the choice of state in which to invest.

Accessibility also plays a key role. States with a lower tax burden, good financing opportunities and high rental demand tend to attract more international investors. In addition, the presence of established foreign communities can make it easier for new owners to adapt and create a more favorable environment for buying property.

Another point to consider is the impact of tourism and internal migration trends in the US. States like Florida and Texas have received a growing influx of new residents and tourists, which has boosted property values and the potential for a return on investment. Growing cities, with modern infrastructure and tax incentives, become even more attractive destinations for investors from outside the country.

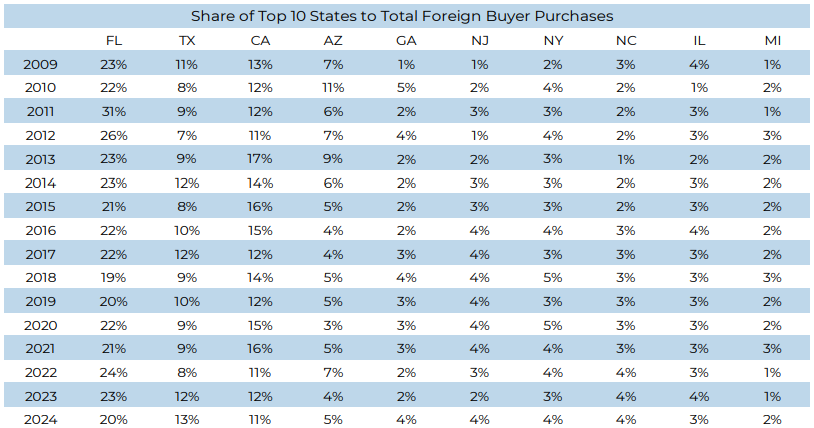

Florida remains the most sought-after state, followed by Texas, California, Arizona and Georgia. Each state attracts investors for different reasons:

-

Florida - 20%

- Florida continues to be the main destination for international buyers due to its warm climate, beautiful beaches and exemption from state income tax. In addition, the strong presence of foreign communities, especially Latinos and Canadians, makes the state more attractive to these investors.

- Texas – 13%

- Texas is attracting more and more investors due to its growing real estate market and favorable business environment. Cities like Houston, Dallas and Austin offer good employment and investment opportunities, as well as lower taxes compared to other states.

- California – 11%

- California continues to be a popular destination, especially among Chinese buyers, due to its educational opportunities and proximity to Asia. In addition, California's cities offer a strong economy and a high-value real estate market, making it an option for high-income investors.

- Arizona – 5%

- Arizona has attracted retirees and investors looking for a lower cost of living and a warm climate all year round. In addition, cities like Phoenix offer good opportunities for short- and long-term rentals.

- Georgia, New Jersey, New York and North Carolina - 4% each

- Georgia: The city of Atlanta has a strong rental market, driven by economic growth and transportation infrastructure.

- New JerseyNew Jersey's proximity to New York makes it a viable option for investors looking for more affordable real estate in the metropolitan area.

- New York: Although the cost of real estate is high, New York remains one of the most valued markets in the world, attracting luxury buyers.

- North Carolina: Technological and industrial growth in the Raleigh-Durham region has attracted investors interested in long-term rental properties.

The profile of international buyers varies according to nationality, the objectives of the purchase and the type of financing used. Many foreigners buy real estate in the USA to diversify their investments, looking for a asset in a strong currency with long-term appreciation potential. In addition, the purchase of real estate in the USA is often associated with an interest in housing, either as a second home or to accommodate family members who study or work in the country.

Most international buyers opt for properties in urban and suburban areas, where there is a greater supply of services, infrastructure and rental opportunities. In addition, the tendency to buy for rental purposes is growing, especially in tourist cities with a strong short-term rental market, such as Orlando and Miami.

Another relevant factor is the method of payment. While US resident buyers usually finance a significant part of the purchase, non-resident foreigners often make cash transactions. This strategy guarantees greater negotiating power and also allows for a more agile purchasing process, increasing the competitiveness of the international investor in the US real estate market.

Payment method

- 50% paid cashcompared to 28% for general buyers.

- 68% of non-resident foreigners paid cashagainst 36% of residents.

- Canadians (69%) and Chinese (68%) were the ones who bought the most without financing.

The Brazilians follow a similar trend, with a significant proportion opting for cash payment. Many Brazilian investors see US real estate as a way to protect their assets the volatility of the Brazilian real and the country's economic instability. In addition, the search for quality of life and opportunities for appreciation makes the American real estate market a strategic choice for this public.

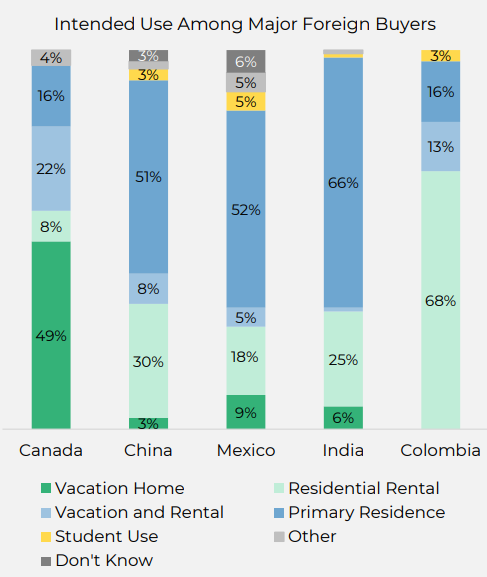

Use of the property

The use of the property purchased by international buyers varies according to the investor's profile and financial objectives. Many foreigners opt for properties in the USA as second homeThey are taking advantage of the country's economic stability to secure a safe place for leisure and relaxation. States like Florida and California are popular with this type of buyer, especially because of their pleasant climate and developed tourist infrastructure.

Another significant proportion of international buyers are looking for real estate for generating passive incomeand investing in properties for short- and long-term rental. The vacation rental sector has grown in recent years, driven by platforms such as Airbnb and the high demand from tourists in regions such as OrlandoLas Vegas and Miami. Cities with a strong flow of tourism represent valuable opportunities for foreign investors interested in making a financial return on their rentals.

In addition, a growing number of international buyers are purchasing real estate in the US to long-term housingWhether to work in the country, study or take up permanent residence. This profile is more common among investors from countries with commercial and academic ties to the US, such as India, China and Brazil. The possibility of using the property as their main home or as accommodation for family members studying in the country also influences the decision to buy.

Regardless of the final use of the property, asset appreciation continues to be one of the main motivators for foreign investment in the American real estate market. The sustainable economic growth of the main US cities makes this type of investment a strategic choice for those seeking long-term financial strength and security.

-

45% purchased real estate for use as a vacation home, rental or both.

-

32% used for their main home.

-

5% acquired for student housing.

This profile reflects the diversification of international buyers' interests. While investors are looking for properties to rent out and increase their value, many foreigners are buying homes in the US as a way of securing a stable residence for their families or children studying in the country.

The US real estate market is constantly evolving, and new opportunities arise as economic and social factors shape the demand for real estate. With the expected reduction in interest rates in 2025, greater accessibility to credit is expected, which could boost purchases by foreigners who previously had difficulty with financing.

Another important trend is the growth of the short-term rental marketThis is driven by the increase in tourism and the popularity of platforms such as Airbnb. Tourist cities such as Orlando and Miami continue to be destinations of high interest to investors looking for temporary rental properties.

Technological and environmental changes are also influencing the market. The increase in the search for sustainable and ecologically certified properties is becoming a relevant factor for international buyers, especially those coming from Europe. Investors paying attention to these trends may find promising niches for real estate development in the coming years.

The US real estate market continues to be an attractive destination for foreigners, especially Brazilians looking for appreciation and financial return. Foreign demand remains robust, driven by interest in investment diversification and opportunities to live and work in the US. For international investors, understanding economic factors and market trends can be crucial to making assertive and profitable decisions.

With a strategic planning and in-depth knowledge, foreign investors can take advantage of the opportunities available in the American real estate sector in a safe and profitable way.

Like the content? The full report from the National Association of Realtors (NAR) provides a detailed analysis of US real estate market trends for international buyers.

Thalita Felisardo

Born on VHS, a Super Nintendo warrior and a lifelong theme park addict. Broadcaster, publicist and Orlando explorer by passion! I used to be Mickey's neighbor and I've made over 100 visits to Disney and Universal parks 🎢. Today I've swapped the enchanted castles for the rocky mountains of Canada, but my heart is still divided between the Northern Lights and the Magic Kingdom fireworks.