Yes! 🙌🏽 The time is coming! As the signs of an interest rate cut intensify, expectations are growing of a new cycle of growth and opportunity for key sectors such as tourism and real estate in Florida. Learn more about interest rates in the US and the real estate market in Florida.

Interest rates in the United States have returned to the center of attention following incisive statements by the American president, directly calling on the Federal Reserve for an immediate cut. For foreign investors who closely follow the real estate market in Florida, this move could signal a new phase of opportunities. More than ever, it is important to understand how the US interest rates and the real estate market in Florida are interconnected, and how this relationship can impact your investment decisions.

In this article, we explain what's at stake, compare US interest rates with other countries, and analyze the practical impacts for those investing in houses, apartments and vacation rental properties in the region.

Federal Reserve Chairman Jerome Powell

Contents

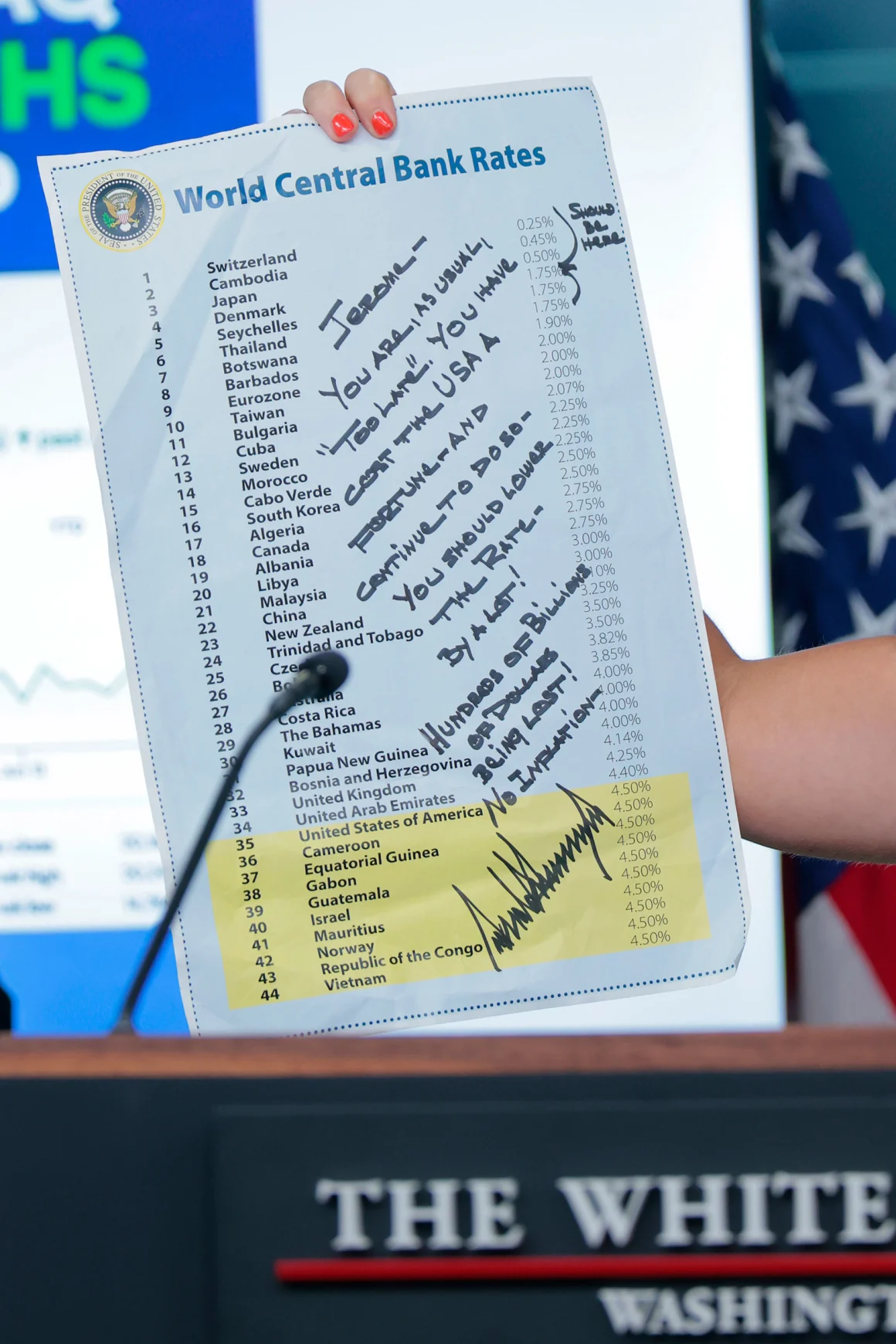

HideIn a recent speech, the president of the United States openly criticized the Federal Reserve for keeping interest rates high even when inflation is under control.

He even sent a direct note to Fed Chairman Jerome Powell, saying:

"Jerome, you are, as always, late. You've cost the US a fortune and continue to do so. You should cut rates significantly."

The central argument is that the American economy continues to heat up, inflation is falling and high interest rates are penalizing consumers and investors.

The president also presented a graph showing the basic interest rate in various countries. See below for a simplified comparison:

| Country | Interest Rate (1TP3Q) |

|---|---|

| Switzerland | 1.50 |

| Japan | -0.10 |

| Canada | 4.75 |

| United Kingdom | 5.25 |

| United States | 5.50 |

| Thailand | 2.50 |

| China | 3.45 |

This difference makes credit more expensive in the US, which affects everything from student loans to mortgages.

Below, White House Press Secretary Karoline Leavitt holds a handwritten note from Trump to Powell during a press conference at the White House on June 30, 2025.

Real estate financing with more expensive installments: With high rates, financing becomes more onerous, which significantly increases the value of the monthly installments. This can put off buyers who depend on credit, especially investors looking for short- and medium-term returns.

Reduced purchasing power for Americans and foreigners: With higher interest rates, the amount of property a buyer can finance with the same income decreases. An investor who could afford a US$ 500,000 house starts looking at a US$ 400,000 house, for example, which squeezes demand for higher value-added properties.

Increased stock of stranded homes: Expensive credit reduces the speed of sales, which leads to a build-up of inventory on the market. With more options sitting idle, owners may need to reduce prices or offer incentives to sell.

Slower appreciation of real estate: In a less heated market, the pace of appreciation tends to slow down. The return on invested capital takes longer, which requires greater patience and strategy on the part of investors.

On the other hand, if the Fed gives in to pressure and begins cuts later this year, the landscape changes:

Lower mortgage rates (today above 7% on average): As prime rates fall, banks tend to follow suit, reducing mortgage interest rates. This makes financing more attractive and encourages new buyers.

Greater liquidity in the market: Lower interest rates increase the circulation of money and the availability of credit, which facilitates transactions, speeds up sales and boosts the sector.

Valuation of existing assets: As demand picks up again, real estate prices could rise again, benefiting those who already own property. This also favors resale and increased return on investment.

Opportunity to buy before the race: Attentive investors can position themselves before the expected fall in interest rates materializes, acquiring properties on more advantageous terms and benefiting from future appreciation.

Consider a US$ 400 thousand for a property in Orlando:

- With interest of 7.25% per year (current), the installment is approx. US$ 2,728/month;

- If it drops to 5.50% per year, the same installment drops to US$ 2,271/month.

In other words: a saving of US$ 457 per month, which represents more than US$ 5,400 per year.

For those who intend to invest in vacation rental properties, this cost relief can significantly improve cash flow.

The Federal Reserve has meetings scheduled throughout the second half of 2025. If the talk of slowing inflation continues, there is a good chance of a cut in prime rates.

For foreign investors, this means:

The right time to evaluate opportunities before they are valued: If the Fed announces the first rate cut, it is likely that the expectation of appreciation will be anticipated, boosting prices. Evaluating and negotiating in advance of such a move can guarantee more attractively priced properties and wider future profit margins.

Possible increase in competition for financed homes: As soon as the cuts are confirmed, many buyers who had been waiting in the wings may return to the market aggressively. This is true for both Americans and foreigners, especially in regions like Orlando and Miami, where the tourist appeal is strong.

The need to act quickly and plan: A scenario of falling interest rates calls for agile decisions. Having credit pre-approval, a reliable local consultant and a clear strategy can be the difference between securing a good deal or missing out on a hotly contested opportunity.

There has still been no official response from the Fed to the president's demands, but the political pressure has reignited the debate on the pace of US monetary policy.

If you follow US interest rates and the real estate market in Florida, this is the ideal time to do it:

- Review your acquisition or sale planning;

- Simulate financing scenarios;

- Prepare for market movements.

Here at The Florida LoungeWe closely monitor all the economic factors that affect your investments.

Contact one of our Florida real estate investment specialists and find out what opportunities are available for your profile. We're ready to help you make strategic decisions with confidence and quality information.

Sources used and recommended:

-

Federal Reserve - U.S. Interest Rate (Fed Funds Rate)

Official source of Fed meetings and monetary policy decisions. -

Trading Economics - Global Interest Rates Comparison

Database used to compare interest rates by country. -

Mortgage News Daily - Current Mortgage Rates

Reference to average residential mortgage rates in the USA. -

CNBC - Biden calls on Fed to cut interest rates

-

Zillow Mortgage Calculator

Used to simulate the installment values in the practical examples.

Thalita Felisardo

Born on VHS, a Super Nintendo warrior and a lifelong theme park addict. Broadcaster, publicist and Orlando explorer by passion! I used to be Mickey's neighbor and I've made over 100 visits to Disney and Universal parks 🎢. Today I've swapped the enchanted castles for the rocky mountains of Canada, but my heart is still divided between the Northern Lights and the Magic Kingdom fireworks.

Related Posts

September 25, 2025

Panorama atualizado do aluguel em Orlando em 2025

Construction cranes aren't the only things going up amid Orlando's boom. This…