Mortgage rates fall in Florida

In recent months, the US real estate market has been impacted by historically high interest rates, which have reduced the purchasing power of many investors and buyers. Now, the scenario is beginning to change: the mortgage rates in Florida have already fallen to levels close to 6,125%This opens up a strategic window for those wishing to finance a property in the state.

This reduction comes amid expectations of cuts in the Fed's prime rate and a fall in Treasury bond yields, factors that directly influence real estate financing. The impact is immediate: buyers who were previously in doubt gain more confidence, and properties that seemed out of their budget fit back into their plans. For investors, this means not only greater accessibility, but also greater potential for appreciation in the short and medium term.

Contents

HideThe fall in mortgage rates in Florida is directly linked to the economic scenario in the United States. Although the Federal Reserve (FED) has yet to officially confirm a cut in the basic interest rate, the market is already anticipating this possibility. When investors see signs of an economic slowdown, such as a reduction in the pace of hiring and more controlled inflation, yields on 10-year Treasury bonds fall.

This movement has an immediate effect on the real estate sector, since mortgages follow the variation in these securities. The result is a drop in mortgage rates, allowing buyers to obtain more favorable conditions. Banks and financial institutions, aware of the competition, are adjusting their offers and some are already working with rates from 6.125%.

For the Florida market, this change is even more relevant: as a favorite destination for foreign investors and families in search of quality of life, a drop in interest rates broadens the base of qualified buyers and accelerates purchase decisions.

📊 Florida market data

Here are some of the latest figures for comparison:

| Product / Deadline | Current average rate in Florida | Source |

|---|---|---|

| 30-year mortgage (fixed rate) | ~ 6,24% | Bankrate - "Current mortgage rates in Florida ... 30-year fixed mortgage" (Bankrate) |

| 15-year mortgage (fixed rate) | ~ 5,64% | Bankrate - same page (Bankrate) |

| 30-year mortgage (fixed rate) | ~ 6.52% APR | NerdWallet - average rates for 30-year fixed APR in Florida (NerdWallet) |

| 30-year mortgage (fixed rate) | ~ 6,25% | Mortgage News Daily - fixed origination rates in FL for 30 years (Mortgage News Daily) |

Some banks may require a down payment of more than 30%, especially when the property is intended for short season or use as a vacation rental, as these properties carry a higher risk of vacancy, local regulations and the need for extra insurance. The type of property (e.g. coastal, condominium, or tourist properties) has a major influence: not only on the down payment percentage, but also on the appraisal requirements, mandatory insurances (such as flood insurance, property insurance, storm insurance), and documentation scrutiny. These stricter conditions make the 6.125% rate more affordable for those who meet all the requirements (significant down payment, strong credit, good risk profile).

These are the factors that are almost always present when someone achieves a rate in this range:

-

Excellent credit / high score

-

Have a credit score significantly above the minimum required. The closer to "top tier", the lower the risk for the bank → the better the rate.

-

Bass Debt-to-Income Ratio (DTI), i.e. total debt compared to monthly income needs to be at a healthy level.

-

-

Down payment high

-

Entries of 20% or more usually help a lot, because they reduce the financier's risk and eliminate or reduce requirements such as private mortgage insurance (PMI).

-

The more immediate equity, the better the negotiating power of the rate.

-

-

Type of property, value and loan compliance

-

Standard property, location with a good market, value within the "conforming" limits or the type of loan that entities such as Fannie Mae / Freddie Mac accept.

-

Jumbo loans tend to have higher rates, but there are cases of competitive jumbo rates too, depending on the bank.

-

-

Specific financial institutions

-

Smaller banks or credit unions usually offer more flexible conditions, promotional rates or rate buydowns, as long as you meet the criteria.

-

Real example: a Power Financial Credit Unionin Florida, shows a rate of 6,125% for a 30-year fixed-rate. powerfi.org

-

Another example: the Seacoast Bank offers, for 30-year jumbo loans, a rate of 6,125% as one of your options. seacoastbank.com

-

-

Special promotions or programs

-

Some credit unions have offers in which they cover part or all of the closing costs (closing costs) or offer discounts if you use a special program or are a member. This lowers overall costs and makes it easier to "get" a low rate.

-

In many cases, in order to have the rate announced, it is necessary to "lock" the rate in advance, meet deadlines, etc.

-

⚠️ Attention to other costs

Even if you get a rate of 6.125%, the effective cost of financing may be higher because of additional expenses, such as:

-

Discount points: charge at closing to "buy" the lower rate, usually 1 point = 1% of the loan amount.

-

Origination fees and underwriting: administrative fees for credit processing and approval.

-

Property appraisal: bank requirement that can cost a few hundred dollars.

-

PMI (Private Mortgage Insurance): mandatory when the down payment is less than 20%, increasing the monthly payment.

-

Taxes and insurance: include home insurance, flood insurance (in risk areas) and property taxes, all incorporated into the final cost.

-

Closing costs: closing costs which can vary between 2% and 5% of the property's value.

| Type of cost / requirement | What it is / when it appears | How it impacts cost effectiveness |

|---|---|---|

| Discount points / Mortgage points | These are fees paid at closing to "buy" a lower interest rate. Normally, 1 point = 1 % of the loan amount, and each point reduces something like ~0.25% in the rate. (NerdWallet) | If you pay points to get 6.125%, you need to calculate whether the extra cost will pay off over the years. If you plan to sell or refinance soon, it may not be worth it. |

| Origination fees / underwriting / processing | Fees charged for the work of opening the loan, credit analysis, appraisal, etc. They can vary greatly depending on the bank and the amount of the loan. | They increase closing costs, widening the gap between the "advertised rate" and the "total cost". |

| Property appraisal | The institution almost always requires a professional appraisal of the house. Depending on the location, this can cost several hundred dollars. | Whether you pay before or at the closing, it enters into the calculation of costs that need to be paid by you. |

| Private Mortgage Insurance (PMI) | If the down payment is less than ~20%, many conventional financings require PMI. | Increase the monthly payment until you reach ~20-22% of equity. This can "eat up" some of the savings from the lower interest rate. |

| Insurance fees, taxes, property insurance / flood insurance | Property taxes, home insurance, and in risk areas, flood insurance. Often required to approve the loan or as part of escrow. | Although they are not interest, they are part of the monthly and annual cost. If forgotten, they can be surprising. |

| Rate-lock fees | If you want to guarantee the advertised rate (e.g. 6.125%) before closing the deal, there may be a cost for "locking" the rate for a certain period. | If the closing is delayed or something changes, there may be an extra fee or the need to "renew" the lock. |

| Closing costs | Various fees at the time of closing: title, registration, insurance, legal fees, etc. | Often 2-5% or more of the value of the property; some banks or credit unions offer "closing cost assistance" or promotions that "pay part". |

Therefore, the rate of 6,125% is real, but it is not available to all profiles. It is a special condition that depends on the buyer's financial history, the structure of the operation and the requirements of each institution. The buyer must evaluate not only the interest rate, but also the complete package of costs, to ensure that the financing is really advantageous.

The recent reduction in mortgage rates in Florida to levels close to 6,125% opens up a real opportunity for those wishing to finance a house. Even apparently small differences in relation to the average market rate, currently around 6,50%This means considerable savings over the years.

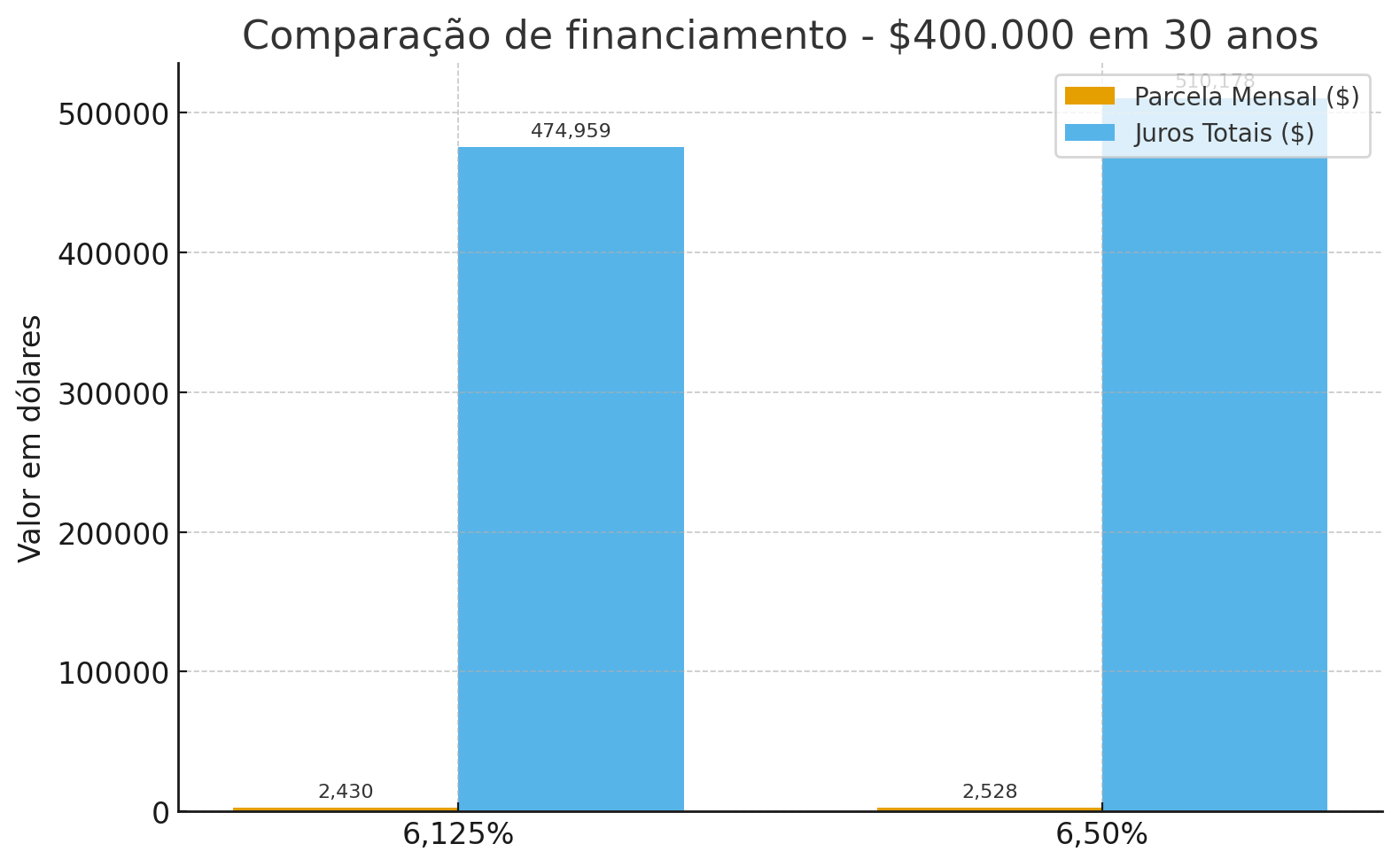

To illustrate, in a US$ 400,000 in 30 years:

-

With a rate of 6,50%the monthly installment would be approximately US$ 2.528.

-

With a rate of 6,125%the monthly installment would drop to US$ 2.430.

This means savings of almost US$ 100 per month and, over the course of 30 years, more than US$ 35,000 in underpaid interest.

This budget relief makes it possible for families who were undecided to move forward with their purchase and for investors to expand their portfolio with high-potential properties in Florida. In addition, lower rates increase accessibility to credit, favoring not only those looking for housing, but also those wishing to invest in vacation homes or long-term rental properties.

In short, the current moment represents a strategic window: those who act quickly can secure more advantageous conditions before the market adjusts again.

The fall in mortgage rates in Florida not only benefits buyers, but also generates positive effects for sellers and investors. When financing costs fall, the market tends to gain momentum: more people qualify for credit, which increases the pool of potential buyers.

For sellersThis means:

-

Greater liquidity: properties tend to sell more quickly, as the number of interested parties grows.

-

Property valuationlower rates support higher prices, as buyers are able to take on larger installments without compromising their budget.

-

More favorable negotiationsIn a scenario of heated demand, there is less need for concessions on the final price.

For investorsThe moment is just as promising:

-

Increased profitabilityproperties intended for seasonal or long-term rental become more attractive, as the reduction in installments increases the net return.

-

Expanding the portfolioThe interest savings make it possible to acquire new properties at a lower cost of capital.

-

Medium-term securityby locking in a competitive rate such as 6.125%, the investor protects himself from possible future market fluctuations.

In short, the drop in rates creates a multiplier effect in the real estate market: more active buyers generate more sales, which in turn strengthen investor confidence and consolidate Florida's appreciation as a global real estate destination.

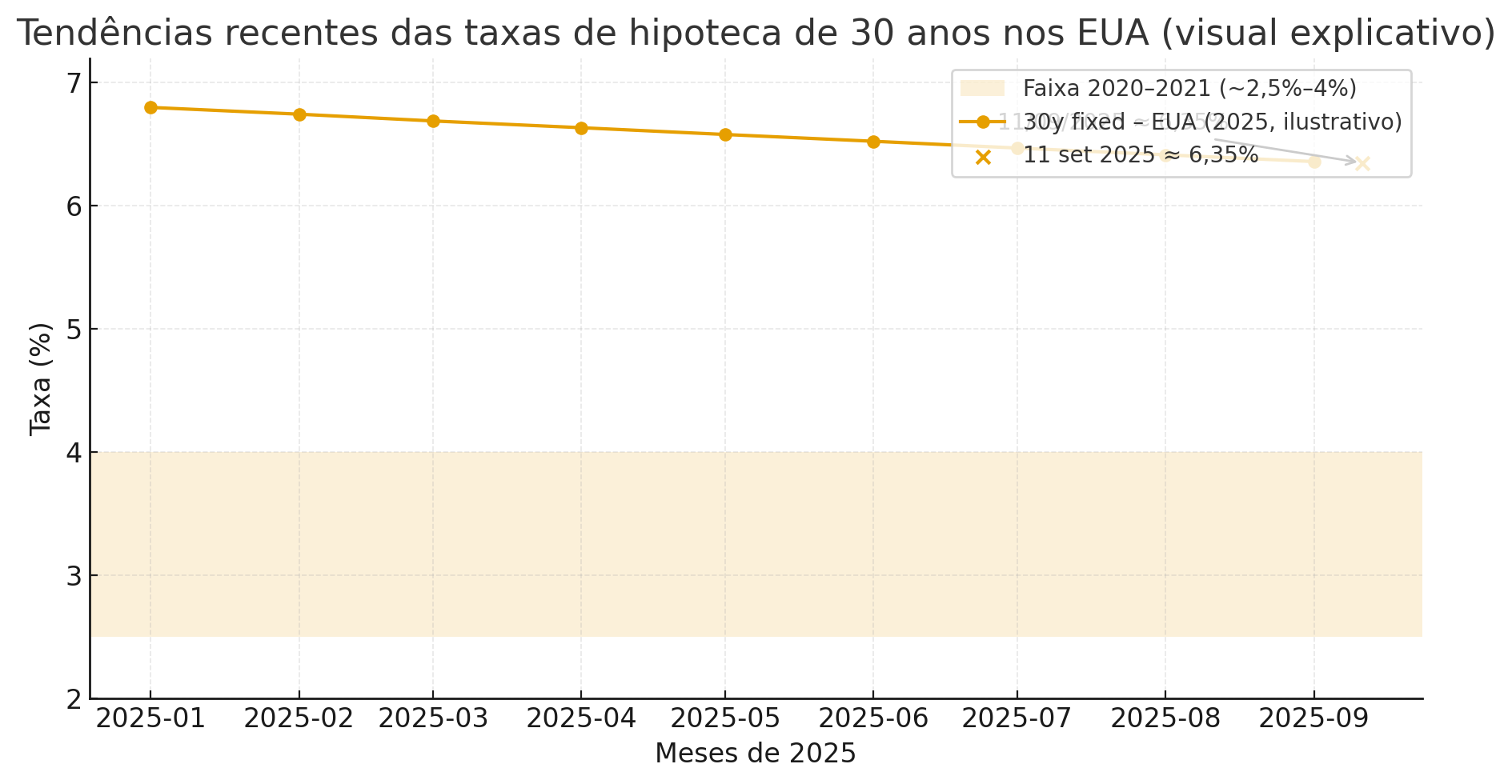

To understand how attractive the 6,125%It is useful to see how mortgage rates have evolved in recent years, both in Florida and in the USA in general.

Recent trends in the USA

-

The 30-year fixed mortgage rate in the US is falling: according to data from the Primary Mortgage Market Survey of Freddie Mac, in September 11, 2025the average was ~ 6,35%. YCharts+3FRED+3The Mortgage Report+3

-

For some months now, these rates have been higher (~6.7-6.8%), especially between the beginning and middle of 2025. YCharts+2The Mortgage Report+2

-

In historical comparison, rates in this range (6-7%) are much higher than in the pandemic period (2020-2021), when rates between ~2.5% and ~4% were observed. The Mortgage Report+1

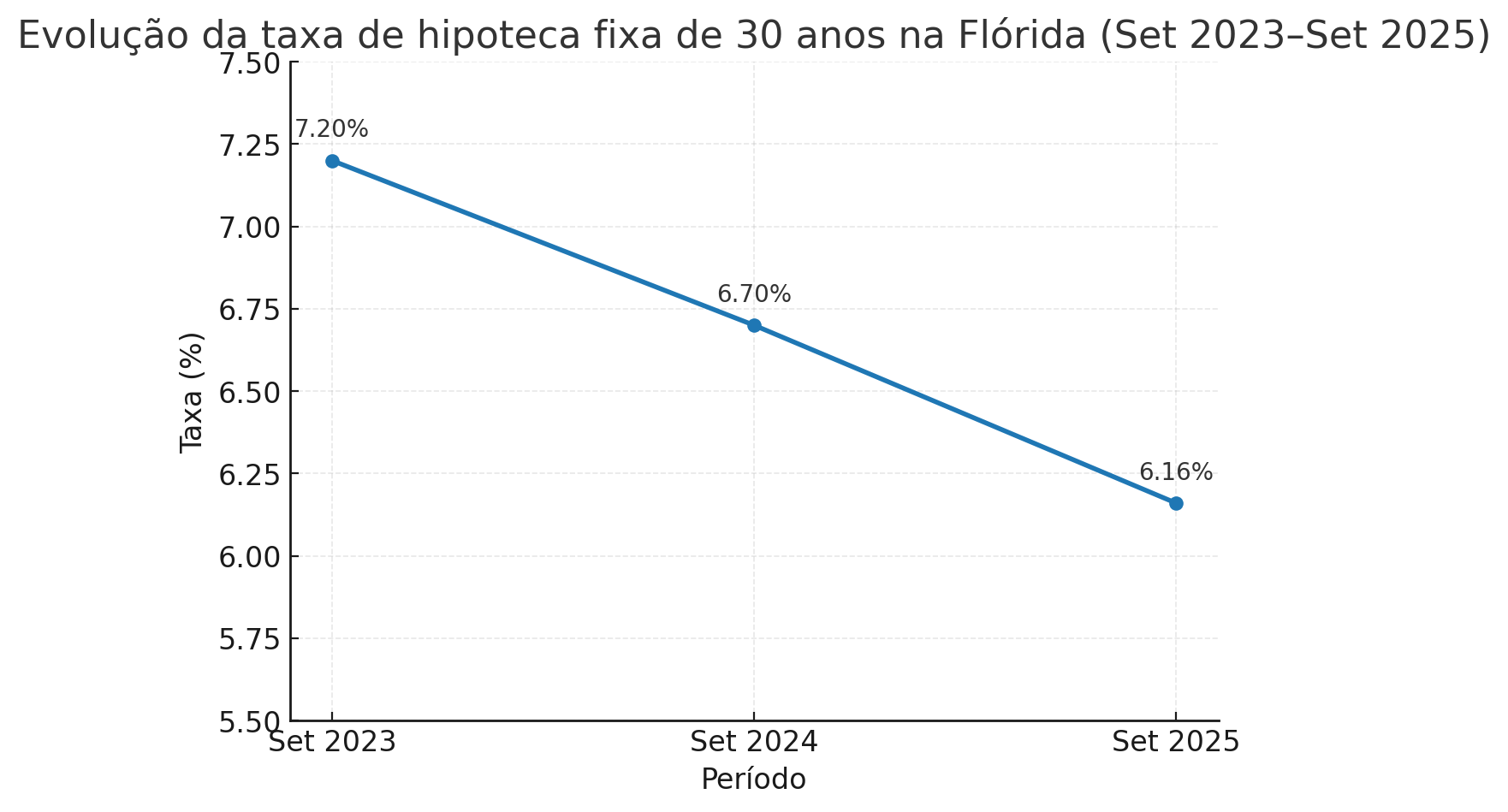

Florida-specific data

-

According to Bankratein September 15, 2025the rate for a 30-year fixed mortgage in Florida was at 6,16%. Bankrate

-

There are also sources that show rates between 6,2-6,5% to 30 years fixed in FL in recent times, depending on the institution and conditions.Bankrate+2Mortgage News Daily+2

See now how mortgage rates in Florida have fallen from 7.20% in September 2023 to just 6.16% in September 2025, a reduction that opens up new opportunities for buyers and investors.

Historical comparison: "where we were and where we are now"

| Period / Year | Average 30-year fixed rate (USA) | Rates observed in Florida / local context* | Context notes |

|---|---|---|---|

| 2020-2021 | ~ 2.5-4% (historic lows) The Mortgage Report+2Bankrate+2 | Far below 6% - exceptional post-pandemic condition | Very low borrowing costs; many refinancings |

| 2022 | Strong rise, reaching ~ 7% or more by the end of the year The Mortgage Report+1 | Florida followed the rise; many buyers left the market or retreated | Inflationary pressure, FED prime rates rising sharply |

| 2023 | Rates remained high, ranging from ~6.5-8% depending on the season Bankrate+1 | Florida also faced high rates; market more cautious | Higher financing costs reduced the volume of transactions |

| 2024 | Average ~ 6.7-7.0% for most of the year, with a slight drop at times The Mortgage Report+1 | FL with rates in this range too; more aggressive offers appeared - but for strong profiles Bankrate+1 | |

| 2025 (until September) | Gradual drop to ~6.3-6.5%, some weeks reaching ~6.35% or slightly less FRED+2YCharts+2 | Florida showing ~ 6.16% for 30 years fixed - rate already close to 6.125% in good conditions Bankrate |

* Local observations depend very much on the bank, credit profile, down payment, etc.

Did you know that the final amount of your mortgage rate doesn't just depend on the bank, but mainly on how you present yourself as a buyer? Good financial planning can mean the difference between being approved with an ordinary rate or securing special conditions, such as the 6,125% that some clients are already winning over in Florida.

Planning means organizing credit, income, tax returns, entry and even how the funds will be transferred to the United States. This preparation brings clear benefits: increases the chances of approval, improves the rate offered, reduces hidden costs and gives you more negotiating power with financial institutions.

In other words, those who organize themselves in advance turn the financing process into a strategy, not just a necessity, and are able to reach the closing with greater security and savings.

1) Define the purpose of the loan (impacts the rate)

-

Main residence usually have the lowest rates.

-

Second homeslightly higher.

-

Investment (rent/STR): requires more input and has pricing hits bigger.

→ Choosing the right category from the start avoids failures and surprises in pricing.

2) Credit (FICO) and behavior in the 90-180 days prior

-

Practical goal: FICO 740+ (the bigger, the better the rate).

-

Actions: keep using the card ≤10-20% of the limit; pay invoices before the cut-off date; no open/close accounts; avoid hard pulls; correct errors in the report (disputes).

-

ExampleThe only way to reduce the use of 50%→10% is to raise the price by dozens of points.

3) Income and DTI (Debt-to-Income)

-

DTI targetideal ≤43-45% (conventional); very strong profiles sometimes pass 45%, but the rate gets worse.

-

Formula(monthly debt installments + projected PITI) ÷ gross monthly income.

-

Actionsto pay off/renegotiate expensive installments (e.g. car), consolidate debts, postpone financing that would exceed the DTI.

-

Exampleincome $10,000/month ⇒ planned PITI $3,000 ⇒ $1,500 left over for all other debts if the target is 45% (4,500).

4) Self-employed and entrepreneurs: tax planning (legal!)

-

Golden rule: the bank looks net declared income (after deductions) in the last 1-2 years (Schedule C/K-1 etc.).

-

Plan with your accountantinstead of "zeroing out profits" to pay less tax, increase net profit in the 12-24 months prior to purchase for increase qualifying income.

-

Common add-backstruly non-recurring depreciation and expenses can be re-added according to the company's policy. underwriter.

-

ExampleThe businessman makes 250k a year, but only declares 60k profit ⇒ he gets little approval. If, with planning, he declares 120k for 2 years, the approval ceiling and the rate improve significantly.

* Note: everything within the lawwith guidance from CPA. We do not recommend undue "maneuvers".

5) Entry, LTV and bookings

-

20% input reduces risk, eliminates PMI and improves the rate. In investment, 25%+ tends to price better.

-

Booking: 6-12 months from PITI account (or liquid assets) make the file much "stronger".

-

Seasoningkeep funds "parked" for 60-90 dayslarge deposits require proof of origin (foreign: exchange history + remittances).

6) Documentation for foreigners

-

No SSNThere are options (ITIN/foreign national) with more entry and higher rate. Plan create credit history in the US (secured cards, service accounts, etc.) and then migrate to conventional products.

7) Type of product and limits

-

Conventional conforming (within the current FHFA limit) normally better pricing that jumbo.

-

If the value exceeds conformingIf you want to stay in a better price range, re-evaluate the structure (down payment/property value).

8) Rate buydown (points) and break-even

-

Discount pointspay ~1 point (1%) of the loan amount usually reduces ~0.25 p.p. in the rate (it varies).

-

Calculation: break-even = cost of points ÷ monthly savings.

-

Example: on a loan of $400k, 1 point = $4.000. If the parcel falls into $65/month, payback ≈ 62 months (~5.2 years). If you want to stay >5 years, it makes more sense.

9) Rate lock e float-down

-

Lock the rate (lock) at the right time (windows of 30/45/60 days). Ask about option float-down if the market falls before the close.

10) Property and rental income (investor/STR)

-

DSCR loans (qualifies by the property's cash flow) ask for DSCR ≥1.0-1.2The higher the DSCR, the better the rate.

-

To short-term rentalSelect markets with strong daily rates and robust documentation (1007 appraisal, history, responsible projections). Rates are higher than primary residences, so revenue planning is crucial.

11) Recommended timeline

-

12-24 months beforealign tax strategy with the CPA; adjust corporate structure/declarations.

-

6-9 monthsoptimizing credit, reducing DTI, accumulating reserves, seasoning entry.

-

60-90 days: pre-approvalcomplete documentation, compare products, product strategy lock.

-

30-45 days: offer accepted, appraisal, conditions, closing.

12) Document checklist (speeds up and avoids overlays)

- ID/passport and immigration status; latest 2 months bank statements; 2 years of W-2/1099/statements (or Bank Statement programif applicable); paystubs recent; gift letters (if any); source of funds; articles of incorporation/K-1; exchange/remittance history (for capital coming from abroad).

How The Florida Lounge helps: our financing specialist makes the profile diagnosis, simulates DTI/LTV, coordinates tax planning with its CPA, defines points/lock strategy, and presents bank and credit union options with a higher probability of approval + best rate for your case. Do you want to apply this plan to your profile? Fill in the form below and we'll put together a roadmap personalized.

The reduction of mortgage rates in Florida to levels close to 6,125% represents a unique opportunity to turn plans into reality. Whether you want to buy your own home, invest in a vacation property or expand your real estate portfolio, this is the ideal time to act before the market adjusts again.

In The Florida LoungeWe understand that financing is a crucial stage in any property purchase. That's why we have a specialist dedicated exclusively to financing processesWe are ready to accompany you in every detail and guarantee the best conditions available. We also have direct relationship with the main banks and financial institutionsThis allows us to offer competitive rates and tailor-made solutions for each client profile.

If you want to take advantage of this window of opportunity and take the next step with security and professional guidance, fill in the form below and talk to our team now.

This article has been developed based on consolidated information on the Florida real estate market, the practical experience of our experts and the support of partner companies that are part of our structure:

Data sources and context on mortgage rates

-

Freddie Mac - Primary Mortgage Market Survey (PMMS)

Weekly data on average mortgage rates in the US. -

FRED - Federal Reserve Bank of St. Louis

Historical series of average 30-year mortgage rates in the USA. -

YCharts - 30 Year Mortgage Rate

Evolution of 30-year mortgage rates in recent years. -

The Mortgage Reports - Historical Mortgage Rates Chart

Historical context of rates, including pandemic period (2020-2021). -

Bankrate - Mortgage Rates in Florida (set/2025)

30-year fixed rate on 15/09/2025 for Florida (6.16%). -

NerdWallet - Current Mortgage Rates in Florida

Compare rates by institution and term. -

Mortgage News Daily - Florida Mortgage Rates

Real-time tracking of average rates in Florida. -

Power Financial Credit Union - Fixed Rate Mortgages

Example of an institution offering a rate of 6.125%. -

Seacoast Bank - Mortgage Rates

Example of a regional bank with rates of 6.125% for some products. -

NerdWallet - Discount Points Explained

Explanation of discount points and calculation of break-even.

Thalita Felisardo

Born on VHS, a Super Nintendo warrior and a lifelong theme park addict. Broadcaster, publicist and Orlando explorer by passion! I used to be Mickey's neighbor and I've made over 100 visits to Disney and Universal parks 🎢. Today I've swapped the enchanted castles for the rocky mountains of Canada, but my heart is still divided between the Northern Lights and the Magic Kingdom fireworks.