O Orlando real estate market 2025 is showing clear signs of transition. After years of accelerated appreciation, the scenario now shows a balance between buyers and sellers. The stock of properties has reached its highest level since 2011, and average prices remain stable, bringing a very different dynamic from the height of the pandemic, when homes were sold in a few days and above list value.

This movement is closely followed by local economists and realtors, who see the change as healthy. The wider offer reduces the pressure on prices and gives buyers back the opportunity to calmly analyze their options before making a deal. At the same time, sellers need to adapt, because what used to sell "on its own" now requires a marketing strategy, professional photos and correct pricing.

Contents

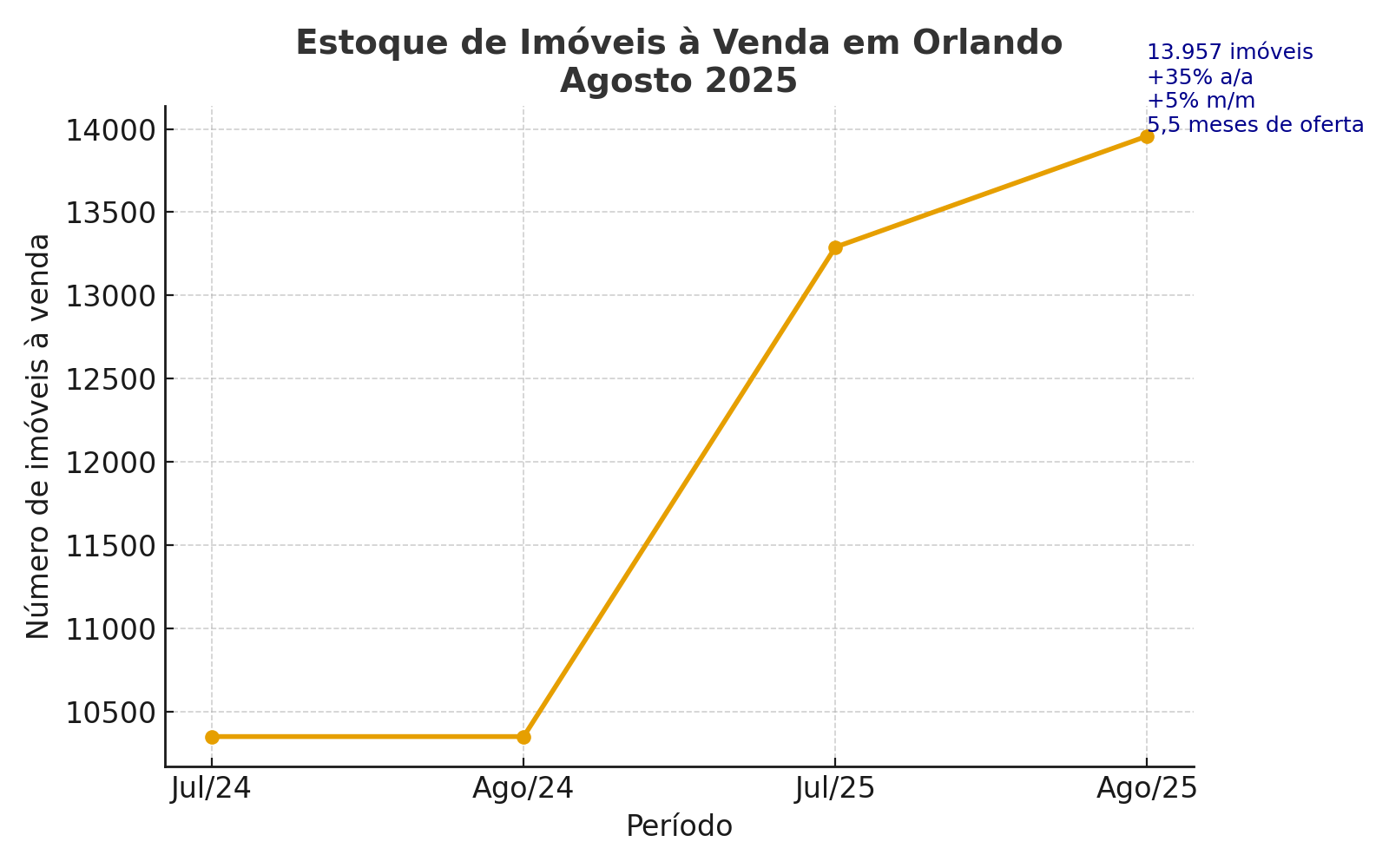

HideIn August 2025, Orlando registered 13,957 properties for salea growth of almost 5% compared to July and more than 35% compared to the same month in 2024 according to the Florida Realty Marketplace. This stock represents the highest volume in over a decade and is approaching 5.5 months of supply, close to the point considered equilibrium by the real estate sector.

This increase in inventory has a direct impact on the behavior of the Orlando 2025 real estate market. Buyers who were previously forced to compete for homes with multiple offers are now finding more peace of mind and bargaining power. For sellers, this means a greater need to differentiate their properties on the market, whether with professional home staging, virtual tours or even one-off refurbishments to attract attention.

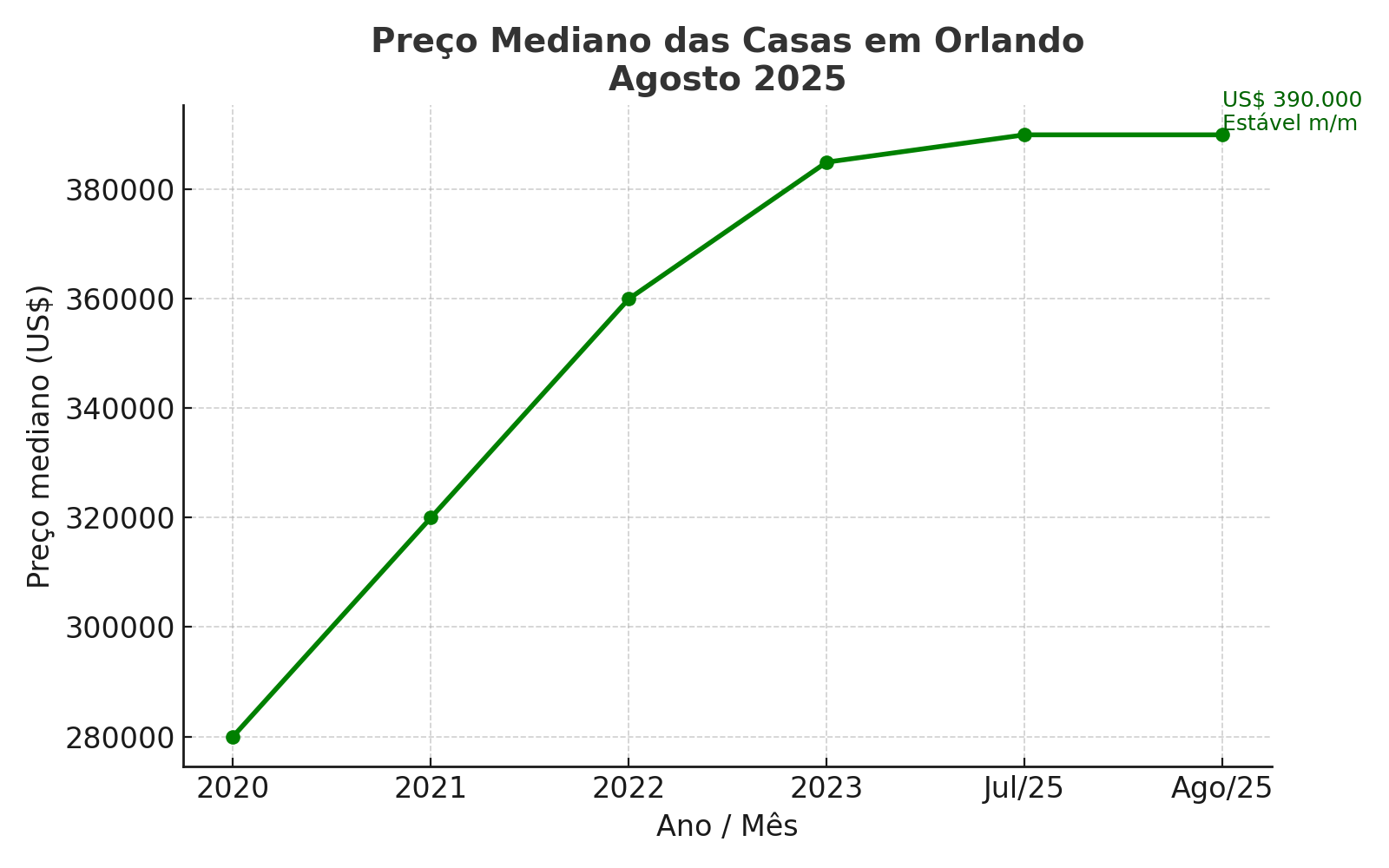

The median selling price of homes in Orlando was US$ 390,000 in August 2025This is practically stable compared to the previous month, according to a survey carried out by the World Property Journal. This stability is in contrast to the years 2020 to 2022, when appreciation reached double digits per year. Experts now believe that the slower pace is a sign of the market's maturity.

Some analysts project that the Orlando 2025 real estate market could see a slight price drop in the coming months, especially if inventory continues to grow and interest rates remain high. For buyers, this could represent opportunities to find discounted homes, especially at the end of the year, when sales activity usually slows down.

Another indicator that confirms the change is the average time that properties remain listed on the market. In August 2025, houses remained on average 67 to 68 days on salean increase of around 12% compared to the previous year. This longer period gives buyers room to negotiate prices and conditions, as well as avoiding the pressure typical of heated markets.

For sellers, however, the challenge is greater. With more exposure time, the property needs to be attractive from the first click. This includes professional photographs, complete and realistic descriptions, and efficient digital strategies. In the Orlando 2025 real estate market, it's not enough just to list the house, you need to create a compelling sales experience to stand out.

The trend observed in Orlando follows the movement in other Florida cities. According to data from Florida Realtors, the state recorded an increase in inventory in May and a slight drop in the number of listings. 2.7% at the median price of single-family homes. This suggests that the state market as a whole is entering a phase of equilibrium, after years of intense appreciation.

The association's president, Tim Weisheyer, pointed out that:

"This rebalancing is positive for both buyers and sellers."

In the context of the Orlando 2025 real estate market, this means that the coming months should be marked by greater stability, with buyers benefiting from more options and sellers adjusting expectations to close good deals.

For those thinking of investing in Orlando, 2025 could prove to be a unique window of opportunity. With a growing stock of properties and stabilized prices, there are more chances to negotiate favorable conditions. This is especially advantageous for buyers who want to purchase a property to generate income from short or long-term rentalIt also takes advantage of the region's tourist and migratory strength.

In addition, real estate financing in the United States remains accessible to foreigners, even in a scenario of higher interest rates than during the pandemic. Banks and financial institutions offer credit options that make it possible to leverage the investment, transforming the purchase into an income-generating asset with the potential for future appreciation. In the context of the Orlando 2025 real estate market, this means that investors can enter a more balanced cycle now and reap results in the coming years.

The Orlando 2025 real estate market shows that the city continues to be one of the most attractive destinations for those looking to invest in real estate in the United States. More homes available, stable prices and greater negotiating power create an ideal scenario for strategic buyers. For sellers, it's time to align expectations and rely on specialists who know how to position properties competitively.

In The Florida LoungeWe have experience in guiding Brazilians and international investors to identify the best opportunities, negotiate safely and structure the right financing. If you want to take advantage of this market moment, fill in the form below and talk to one of our consultants right now.

Thalita Felisardo

Born on VHS, a Super Nintendo warrior and a lifelong theme park addict. Broadcaster, publicist and Orlando explorer by passion! I used to be Mickey's neighbor and I've made over 100 visits to Disney and Universal parks 🎢. Today I've swapped the enchanted castles for the rocky mountains of Canada, but my heart is still divided between the Northern Lights and the Magic Kingdom fireworks.

Related Posts

September 25, 2025

Panorama atualizado do aluguel em Orlando em 2025

Construction cranes aren't the only things going up amid Orlando's boom. This…