In 2025, investing in real estate in Florida has become one of the best decisions for foreigners looking for security, appreciation and passive income. More than just a tourist destination, Florida is becoming a strategic hub for real estate investors.

Find out why investing in real estate in Florida in 2025 is one of the best decisions for foreigners. See the data, advantages and opportunities.

Florida is widely known as one of the most desirable tourist destinations in the world, attracting millions of visitors every year with its paradisiacal beaches, iconic theme parks and year-round pleasant climate. However, in addition to being a hub for entertainment and leisure, the state also stands out as one of the most promising real estate markets in the United States. With a diversified economy, rapid population growth and state-of-the-art infrastructure, Florida offers exceptional opportunities for investors looking for security, profitability and property appreciation.

In 2025, investing in real estate in Florida has established itself as one of the safest and most profitable strategies for those seeking solid returns and property appreciation. More than just a tourist destination, Florida attracts investors from all over the world due to its favorable economic scenario, tax benefits and high demand in the real estate market.

With financing facilities for non-residents, a booming economy and a solid real estate sector, Florida has established itself as one of the best destinations for real estate investments. Whether it's for generating rental income, long-term appreciation or portfolio diversification, the state offers ideal conditions for those who want to invest safely and strategically in the US real estate market. In this article, we explore the main factors that make Florida a smart choice for investors in 2025.

Contents

Hide-

Economic Growth

Florida has stood out in recent years for its vigorous economic growth, consistently outperforming the US national average In 2024, the state's real Gross Domestic Product (GDP) reached an all-time high. growth of 3.2%while the national average was 2.7%. This robust performance is the result of a combination of factors, including favorable tax policies, sector diversification and a favorable environment for those wishing to invest in real estate in Florida 2025.

Between 2021 and 2023, Florida experienced a significant population increase, with more than 400,000 new residents settling in the state. This population influx has not only broadened the consumer base, but has also attracted

Florida Economic Growth Data and Statistics

Florida's real estate market has been one of the pillars of this growth. In 2021, approximately 179,000 housing units were built, a figure which, despite a slight reduction to 160,000 in 2022, demonstrates the resilience of the sector even in the face of economic challenges such as inflation and rising construction costs. In 2023, more than 106,000 new residential building permits were issued, indicating a continued demand for housing in the state.

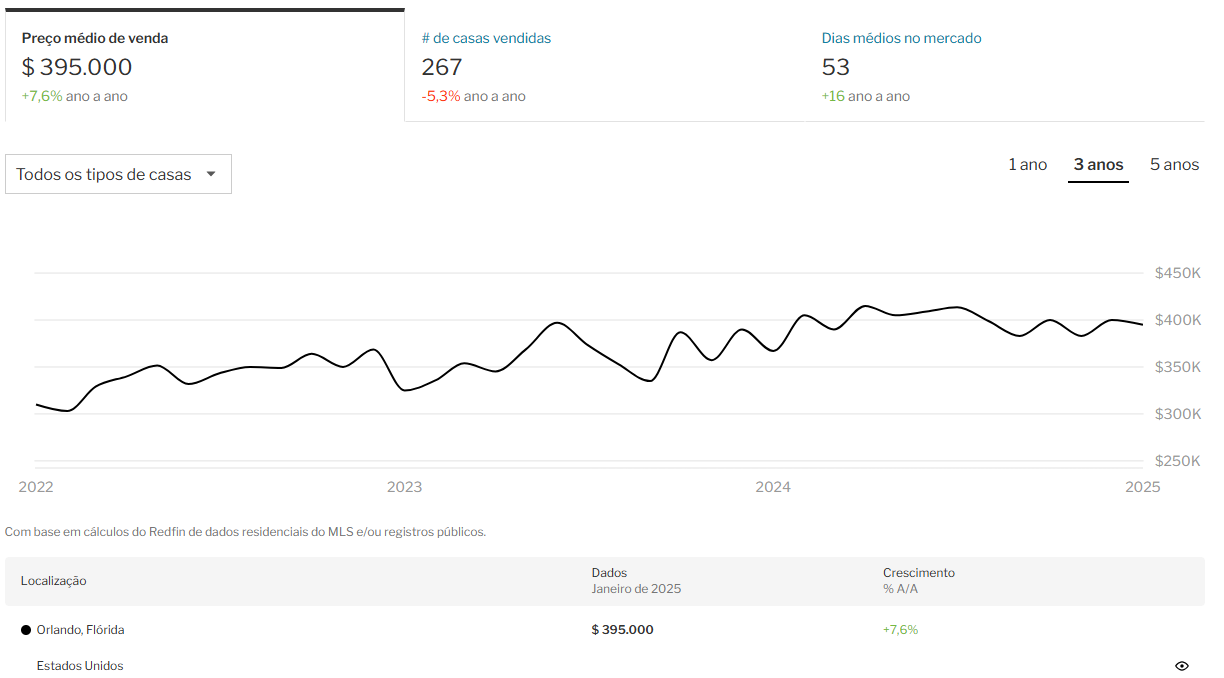

Tourism, Florida's traditional economic engine, also posted significant figures. The Orlando region, for example, recorded a 5% increase in real estate sales in July 2024 compared to the same period last year, with property values rising by an average of 7%. This performance reflects the recovery and expansion of the tourism sectorwhich attracts millions of visitors every year, boosting various segments of the local economy.

Sectors that drive the state's economy

Tourism remains one of Florida's main economic drivers. Cities like Orlando, home to renowned theme parks, attract millions of tourists every year, generating significant revenue and stimulating the local job market. In addition, tourism boosts the short-term rental market, benefiting real estate investors looking for attractive returns in this segment.

The technology sector has been gaining prominence, with renowned companies establishing operations in the state. Microsoft, for example, opened an office in Miami focused on Latin America, while Red 6, which specializes in augmented reality for aviation, moved its headquarters from California to downtown Miami and established a new technology center in Orlando. These moves reinforce Florida's position as an emerging technology hub.

The health sector has also shown remarkable growth, with investments in hospital infrastructure and medical research. The expansion of quality health services attracts not only local residents, but also patients from other regions, strengthening the economy and the economy. generating specialized jobs. In addition, international trade remains an economic pillar, with busy ports> and a strategic geographical location that facilitates the flow of goods between the United States, Latin America and other regions.

Impact of Economic Growth on the Real Estate Market

Florida's economic growth has had a direct and positive influence on the real estate market. The arrival of new residents and businesses has increased the demand for residential and commercial real estate, resulting in a significant appreciation of properties. According to data from Florida Realtors, the average value of homes in the state has increased by 17% in the last two years, reflecting the region's attractiveness to investors and new residents.

In addition, population growth and business expansion have stimulated the development of new residential and commercial areas. Previously underdeveloped regions are undergoing revitalization processes, with investments in infrastructure and services, becoming hubs of growth and real estate opportunities. This dynamism in the real estate market not only meets existing demand, but also projects a promising scenario for future investments in the state.

-

Job market

Florida has demonstrated a robust labor market, characterized by low unemployment rates and constant job creation. In August 2024, the state unemployment rate remained at 3.3%, lower than the national average of 4.2%. This performance highlights the state's resilience and ability to generate opportunities, even in the face of economic challenges in other regions.

Florida's workforce grew significantly, with sectors such as leisure and hospitality, education and health, and construction leading the way in job creation. Between August 2023 and August 2024, the leisure and hospitality sector added 7,300 jobs, while education and health contributed 3,900 new positions. Construction also showed growth, with 1,000 new jobs in the same period.

Unemployment Rate in Florida and its Comparison with the National Average

Historically, Florida has maintained unemployment rates below the national average. In July 2023, the state unemployment rate was 2.7%, compared to 3.5% nationally. This difference indicates a warmer and more resilient labor market in the state, attracting professionals from different regions in search of better opportunities.

In recent years, the Florida real estate market has stood out as one of the most warmer of the United States. The combination of population growth, strong rental demand and a favorable economic scenario has boosted property prices and created attractive opportunities for investors. Regions such as Orlando, Miami and Tampa continue to show significant growth, both in terms of property appreciation and rental profitability.

The internal migration of residents from other American states, coupled with the arrival of foreigners in search of opportunities, has consolidated Florida as one of the main destinations of real estate investment in the country. With a favorable tax scenario and a booming economy, the trend is for the sector to continue booming, benefiting both home buyers and real estate investors in Florida 2025.

-

Property valuation

A appreciation of real estate in Florida has been one of the most attractive factors for investors. Historically, the state has shown continuous growth in property prices, surpassing the national average in several regions. This trend has been driven by several factors, including population growth, infrastructure and favorable economic conditions.

Florida's real estate market recovered quickly after the 2008 crisis, and the appreciation since then has been impressive. The increase in property prices, combined with the constant growth in demand, has consolidated the state as one of the most dynamic in the US real estate sector. In recent years, cities such as Miami, Orlando and Tampa have seen significant increases in property values.

History of real estate appreciation in Florida

Over the last ten years, the average annual appreciation of real estate in Florida has been approximately 6%, a percentage higher than the national average of 4.5%. During the COVID-19 pandemic, prices have risen even faster, reaching 18.3% in 2021, according to data from Florida Realtors.

Property prices in cities like Miami and Orlando have more than doubled in the last decade. According to Zillow, the average price of a property in Miami in 2013 was approximately US$ 280,000, while in 2023 it reached US$ 590,000. In the case of Orlando, prices went from an average of US$ 180,000 to US$ 430,000 in the same period.

Appreciation forecasts for the coming years

Forecasts for the next few years indicate continued appreciation. Zillow projects growth of approximately 5% per year until 2026, while CoreLogic estimates a accumulated appreciation of 15% by 2028. The main driving factor is the imbalance between supply and demand, since the number of new developments is still below what is needed to meet the population increase.

Factors such as population growth, scarcity of land in valued regions, investments in infrastructure and the state's economic attractiveness will continue to have a positive impact on real estate prices. Florida also stands out for its lack of state income tax, which attracts more investors and buyers.

-

Demand for Rent

The demand for rental properties in Florida has grown exponentially in recent years, driven by both the increase in the local population and tourism. The vacation rental sector has also strengthened with platforms such as Airbnb and Vrbo, making the state one of the main markets for landlords in the United States.

High demand for residential and vacation rentals

Orlando, for example, has an average occupancy rate for short-term rentals higher than 70%especially in areas close to the Disney and Universal theme parks. In Miami, long-term rentals have grown by 15% in the last year, due to the high demand for residences in a market with limited supply.

Factors driving rental demand

Among the factors driving this demand are the growth in tourism, the arrival of new residents from states such as California and New York, and the migration of professionals in search of new opportunities. Florida has welcomed more than 1,142,000 new residents in the last three years, according to the Census Bureau, making it the fastest-growing state in the US.

Passive income potential for investors

The passive income generated by rentals has become increasingly attractive to investors, especially in regions with high demand. The return on investment (ROI) on short-term rentals in cities such as Kissimmee and Davenport can vary between 6% and 10% per year, while in Miami Beach and Fort Lauderdale earnings can exceed 12% per year.

With a booming real estate market and a growing demand for rentals, Florida continues to be one of the best regions for real estate investments in the United States. The trend is for these figures to continue rising, guaranteeing excellent opportunities for those who wish to invest in the sector and generate passive income on a consistent basis.

-

Tax benefits

Florida is one of the most attractive destinations for real estate investors due to its favorable fiscal policy. With the absence of state income tax, property owners find a financially advantageous environment in which to maximize their returns. This condition is especially relevant for foreigners who wish to invest in short or long-term rental properties.

In addition, the property tax burden in Florida is relatively low compared to other American states. The property tax varies between 0.83% and 1.02% of the property's value, depending on the county, while states like New York and California have rates higher than 1.5%. This means that investors in Florida can significantly reduce operating costs and increase profitability.

Tax Benefits for Property Owners

Florida does not charge state income taxThis benefits both residents and foreign investors. This is an important differentiator from states like California, where the tax rate can exceed 13%.

Another positive point is the possibility of deducting operating expenses, including maintenance, insurance, and even interest on real estate financing. Investors can reduce their tax base by declaring these expenses when calculating their US federal income tax.

For those who buy properties for short-term rentals, Florida also allows the deduction of marketing and property management expenses. This makes the investment even more attractive for those looking for consistent and advantageous returns.

Comparing Florida's Tax Burden with Other States

The average property tax rate in Florida is 0.89%, below the national average of 1.08%. States like Illinois and New Jersey charge more than 2% on the value of the property, which can represent a significant difference in annual costs.

In addition to property tax, states like California and New York apply additional capital gains taxes on the sale of real estate, something that doesn't exist in Florida. This means that investors who buy and resell real estate in Florida are able to retain more of the profits.

Another factor to consider is the property transfer tax. While in states like Maryland this tax can reach 1.5%, in Florida the cost is minimal, ranging from 0.35% to 0.7%.

How Tax Benefits Increase Return on Investment

Florida's lower tax burden means that investors can allocate a greater part of the rental income to amortizing financing or reinvesting in new properties. This makes the investment cycle more efficient and profitable.

In addition, the exemption from state income tax allows foreign investors to enjoy a higher net return than in other states, boosting the accumulation of wealth.

With reduced costs and tax incentives, Florida stands out as one of the most favourable markets for investors looking to maximize their profits in a strategic way.

-

Easy financing

Investing in real estate in Florida is also notable for the ease with which you can obtain credit. American banks have specific programs for foreigners, allowing them to purchase properties with competitive financing.

For investors who do not have a credit history in the US, it is possible to access financing lines with a down payment of between 25% and 35% of the property's value and interest rates ranging from 6% to 9%, depending on the buyer's profile.

Financing options for foreigners

Banks in Florida offer mortgages to foreigners no US citizenship required. Terms can vary from 15 to 30 years, and interest rates are competitive compared to other states.

It is also possible to obtain financing through private institutions and credit unions, which offer flexible conditions for foreigners with no banking history in the US.

Financing Programs for Investors

Florida has financing programs aimed at investors who wish to acquire properties for short or long-term rental. American financial institutions offer specific conditions for this type of buyer, including low interest rates and flexible payment terms.

In addition to traditional financing programs, there are also lines of credit aimed exclusively at rental properties, allowing investors to increase their portfolio with differentiated conditions. Banks such as Wells Fargo and JPMorgan Chase offer specific mortgages for real estate investors.

The journey of financing a property in the United States can seem complex to those just starting out. There are many new terms, specific requirements for foreigners, bureaucratic steps and rules that differ greatly from the Brazilian model.

If you feel that you still have doubts about how to finance your property in Florida, we have the ideal resource for you.

📘 Our eBook "How to finance real estate in the USA, even if you're Brazilian" is a practical guide, created especially for those who want to understand the process from scratch - safely and clearly.

You will have access to:

The complete step-by-step guide to American financing;

What documents are required of foreigners;

How to increase your chances of approval;

Information on fees, taxes and the closing process;

Practical tips to avoid the most common mistakes.

💡 If you're serious about investing in the US, this eBook can save you time, avoid headaches and speed up your decision-making process with confidence.

Tips for obtaining financing

To increase the chances of being approved for a loan, it is essential to maintain a good relationship with banks and provide detailed documentation. Having a stable payment history and proving the origin of funds are also factors that help in obtaining credit.

Many banks require a down payment of between 25% and 30% of the property's value for foreigners. In addition, passports, income statements, bank statements and financial references are required.

- Have a bank account in the USA to facilitate transactions.

- Provide proof of income and taxes paid in the country of origin.

- Have a detailed financial plan and demonstrate the ability to pay.

-

Quality of Life

Florida is known for its tropical climate, paradisiacal beaches and state-of-the-art infrastructure, making it a highly attractive location for investors.

With well-planned cities, high levels of safety in certain areas and a reasonable cost of living, Florida is one of the best options for those wishing to invest in highly liquid real estate.

Climate, Security and Infrastructure

Florida is known for its tropical climate, with hot summers and mild winters, making it an ideal destination for tourism and living. This favors the vacation rental market and boosts demand for real estate.

The state's infrastructure is well developed, with modern roads, international airports and a wide range of essential services. Security in planned communities and gated communities is also a factor that attracts investors.

Valuing Real Estate for Quality of Life

The high quality of life offered by Florida has a direct impact on real estate prices. Regions such as Miami, Orlando and Tampa are experiencing constant growth in real estate prices due to the heated demand.

In addition, the presence of good schools, renowned hospitals and leisure centers makes the properties even more attractive to buyers and investors looking for security and convenience.

-

Types of property

Florida is one of the most dynamic real estate markets in the United States, attracting investors from all over the world. With continuous population growth and a diversified economy, the state offers many opportunities for those wishing to invest in real estate. According to the U.S. Census Bureau, Florida's population will grow by 1.9% in 2023, surpassing the national average of 0.4%, driving demand for residential, commercial and vacation real estate.

What's more, Florida has a stable real estate marketwith consistent appreciation rates. According to Florida Realtors, the average sale price of residential real estate rose by 6.4% in 2023, while commercial real estate has appreciated by an average of 5.1% per year over the last decade. This appreciation, combined with the high liquidity of the market, makes Florida an attractive destination for investors of different profiles.

Residential properties

Residential real estate in Florida is extremely varied, covering single-family homes, apartments, townhouses and gated communities. The average price of a single-family home in the state is around US$ 415,000, while apartments and townhouses average US$ 315,000, according to data from Redfin. Among the factors driving demand are increased inward migration from states such as New York and California and a preference for real estate in suburban areas.

Another determining factor for investment in residential real estate is the high rental rate. In cities like Miami and Orlando, around 45% of the population live in rented properties, which creates an opportunity for investors looking for passive income. The average return on residential rent in Florida varies between 5% and 7% per year, making it one of the states with the best rental returns in the USA.

Demand for new real estate is also booming, with several construction companies launching developments in growing regions. In Orlando, for example, neighborhoods such as Lake Nona and Horizon West are appreciating by 8% a year, driven by technological development and the presence of large companies. For investors looking for resale or long-term appreciation, these areas stand out as strategic opportunities.

Commercial Real Estate

Commercial real estate in Florida has proven to be a highly lucrative option, especially in cities with rapid economic growth. The state has a GDP of approximately US$ 1.4 trillion, making it the fourth largest economy in the US. Sectors such as technology, healthcare and tourism have driven demand for commercial space, creating investment opportunities in office buildings, industrial warehouses and retail stores.

Commercial real estate prices vary considerably depending on the location and type of property. In Miami, the average square meter price for commercial space is around US$ 5,000, while in Tampa it can be found for US$ 3,200. According to CBRE, class A office rents in prime areas of Miami appreciated by 7.3% in 2023, driven by the arrival of large financial and technology companies.

Another investment opportunity is in the warehouse and logistics center sector. With the growing demand for e-commerce, cities like Jacksonville and Orlando have registered industrial occupancy of over 95%, making this segment highly attractive. Companies like Amazon and Walmart have expanded their distribution centers in Florida, driving up industrial warehouse prices by more than 12% in the last year.

Vacation properties

The vacation property market in Florida is one of the most profitable in the world, thanks to the constant tourism in the state. In 2023 alone, Florida welcomed more than 137 million visitors, according to Visit Florida. Cities like Orlando and Miami lead this segment, with high occupancy of vacation properties and average daily rates that can exceed US$ 300 during periods of high demand.

Vacation homes in Orlando, especially in gated communities near Disney, are a very popular option for investors. Return on investment (ROI) can reach 10% per yeardepending on location and property management. In Kissimmee and Davenport, regions close to the theme parks, 4 to 6 bedroom houses are the most sought after, with average prices between US$ 400,000 and US$ 600,000.

Another growing trend is resort apartments, which offer hotel services and integrated management. These properties attract both foreign investors and Americans looking for vacation properties without the worry of management. Resorts in Miami Beach, for example, have recorded an appreciation of 8% in 2023, and the average annual occupancy of these properties is around 75%.

Location

The choice of location is one of the most decisive factors in the success of a real estate investment. Florida offers a wide range of options, from dynamic metropolises to emerging cities with high appreciation potential. Elements such as infrastructure, population growth, job offer and tourist attractions should be taken into consideration when selecting an area to invest in.

In recent years, several cities in Florida have become investment hotspots, attracting both domestic and foreign investors. Among the state's main real estate hubs are Miami, Orlando, Tampa, Fort Lauderdale, Jacksonville and Naples, each with its own advantages and characteristics.

Promising Cities and Regions

- MiamiFinancial and tourist center, with a strong luxury and commercial real estate market.

- OrlandoEpicenter of tourism, strong demand for holiday and residential properties.

- Tampa: Growing economy, especially commercial and industrial real estate.

- Fort Lauderdale: Premium real estate market and booming yachting sector.

- JacksonvilleGrowing demand for industrial and commercial real estate.

- Naples: City with a strong retirement market and luxury real estate.

Characteristics of each region

Miami is ideal for investors looking for long-term appreciation and income from vacation rentals. Orlando is an excellent choice for those wishing to invest in vacation homes and high-occupancy residential properties. Tampa has established itself as one of the most stable markets, with strong growth in commercial and industrial real estate. Fort Lauderdale attracts high-end buyers, while Jacksonville stands out in the logistics sector.

Tips for Choosing the Ideal Location

To make the best investment decision, it is essential to analyze factors such as:

- Historical appreciation rate of the region

- Rental demand and average occupancy

- Tax incentives and local regulations

- Economic development and planned infrastructure

- Proximity to business centers, schools and tourist attractions

Regardless of the investor's profile, Florida remains one of the most promising markets in the US, offering many opportunities for appreciation and generating passive income in the real estate sector.

Florida continues to stand out as one of the best destinations for real estate investments in 2025. With a unique combination of tax benefits, ease of financing and a dynamic market, the state offers attractive opportunities for both first-time investors and those who already have a consolidated portfolio. The absence of state income tax and the reduced tax burden make real estate in Florida highly profitable, allowing foreign investors to maximize their profits and expand their investments with greater security.

Throughout this article, we've explored the main factors that make Florida a promising real estate market. From the tax advantages and ease of financing to the quality of life and diverse real estate options, it's clear that the state offers favorable conditions for investors looking for solid returns and asset appreciation. In addition, the growing demand for residential, commercial and vacation properties reinforces the liquidity and profitability potential of the local market.

If you are considering investing in real estate in Florida, now is the ideal time to take advantage of the opportunities available. The market remains hot, with cities such as Miami, Orlando and Tampa showing steady growth in prices and demand for properties. Whether it's to generate passive income from rentals, long-term appreciation or to expand your assets, investing in Florida remains a strategic and safe decision for foreigners looking for diversification and stability.

Contact us for more information on how to start your investment in Florida. Our team is ready to offer specialized support, present the best real estate options and help you make the best decision for your financial goals. Don't miss the chance to be part of this dynamic and profitable market - talk to us today and find out how to make your dream of investing in Florida a reality!

Sources:

📊 Economic and population sources

🏠 Real estate sources

💰 Financing and fees

🧾 Taxation and tax benefits

🎯 Growing sectors and quality of life

Thalita Felisardo

Born on VHS, a Super Nintendo warrior and a lifelong theme park addict. Broadcaster, publicist and Orlando explorer by passion! I used to be Mickey's neighbor and I've made over 100 visits to Disney and Universal parks 🎢. Today I've swapped the enchanted castles for the rocky mountains of Canada, but my heart is still divided between the Northern Lights and the Magic Kingdom fireworks.