Com todas as manchetes e burburinho na mídia, alguns consumidores acreditam que o mercado está em uma bolha imobiliária.

À medida que o mercado imobiliário muda, você pode estar se perguntando o que acontecerá a seguir.

É natural que surjam preocupações de que possa ser uma repetição do que aconteceu em 2008. A boa notícia é que há dados concretos para mostrar por que isso não é nada parecido com a última vez.

Há uma escassez de casas no mercado hoje, não um excedente

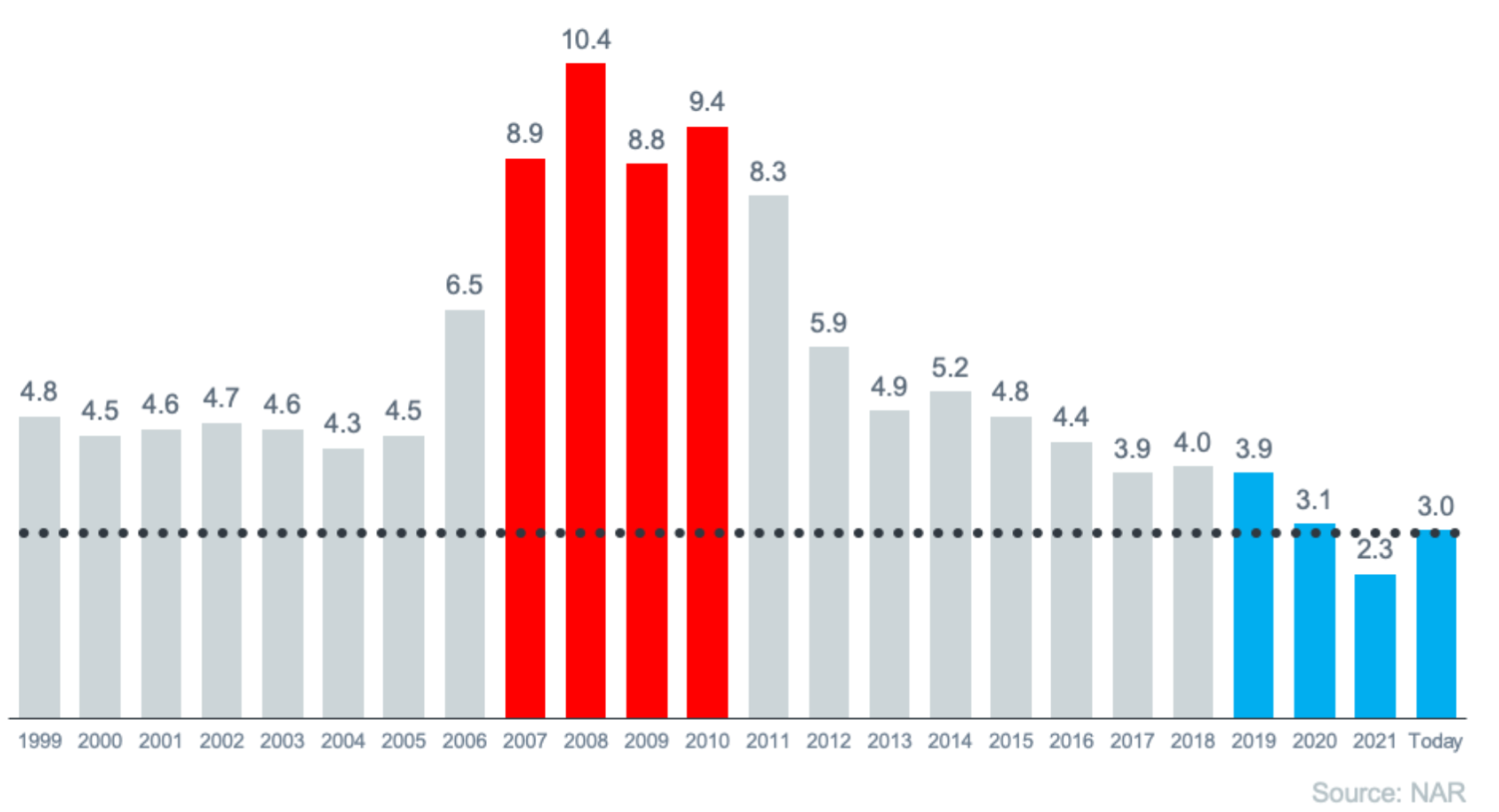

O estoque de casas necessário para sustentar um mercado imobiliário normal é de aproximadamente seis meses. Qualquer coisa além disso é uma superabundância e fará com que os preços se desvalorizem. Qualquer coisa menos do que isso é uma escassez e levará a uma valorização contínua dos preços.

Para o contexto histórico, havia muitas casas à venda durante a crise imobiliária (muitas das quais foram vendas a descoberto e execuções hipotecárias), e isso fez com que os preços caíssem. Hoje, a oferta está crescendo, mas ainda há escassez de estoque disponível.

O gráfico abaixo usa dados da Associação Nacional de Corretores de Imóveis (NAR) para mostrar como esse tempo se compara ao acidente. Hoje, o estoque não vendido é de apenas 3,0 meses no ritmo de vendas atual.

Estoque de casas a vendas em meses

Quantidade de casas a venda dividido pelo volume de compras

Uma das razões pelas quais o estoque ainda está baixo é por causa da subconstrução sustentada. Quando você combina isso com a demanda contínua do comprador à medida que os millennials envelhecem em seus anos de pico de compra de casas, isso continua a pressionar os preços das casas.

[ipt_fsqm_form id=”8″]

Essa oferta limitada em comparação com a demanda do comprador é o motivo pelo qual os especialistas preveem os preços das casas não cairão desta vez.

Os padrões de hipoteca eram muito mais relaxados durante a crise

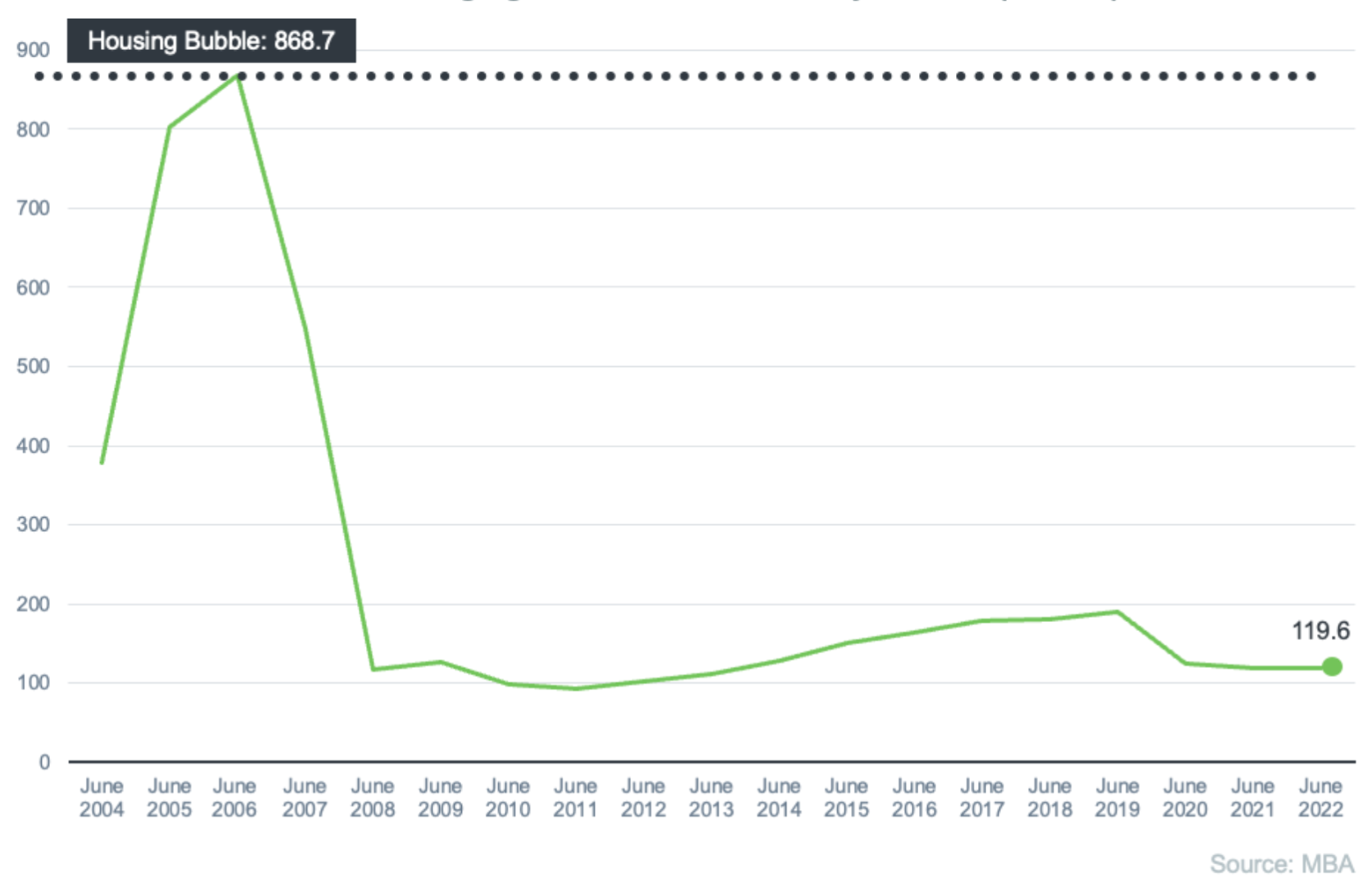

Durante o período que antecedeu a crise imobiliária, era muito mais fácil obter um empréstimo imobiliário do que é hoje.

O gráfico abaixo mostra dados sobre o Índice de Disponibilidade de Crédito Hipotecário (MCAI) da Mortgage Bankers Association (MBA). Quanto maior o número, mais fácil é obter uma hipoteca.

Os Padrões de Financiamento Ainda Estão Controlados

Até 2006, os bancos estavam criando uma demanda artificial baixando os padrões de empréstimos e tornando mais fácil para qualquer pessoa se qualificar para um empréstimo imobiliário ou refinanciar sua casa atual.

Naquela época, as instituições de crédito assumiam um risco muito maior tanto na pessoa quanto nos produtos hipotecários oferecidos. Isso levou a inadimplências em massa, execuções hipotecárias e queda de preços.

Hoje, as coisas são diferentes, e os compradores enfrentam padrões muito mais elevados das companhias hipotecárias. Mark Fleming, economista-chefe da First American, diz:

“Os padrões de crédito ficaram mais rígidos nos últimos meses devido ao aumento da incerteza econômica e ao aperto da política monetária”.

Padrões mais rígidos, como existem hoje, ajudam a evitar o risco de uma erupção de execuções hipotecárias como houve da última vez.

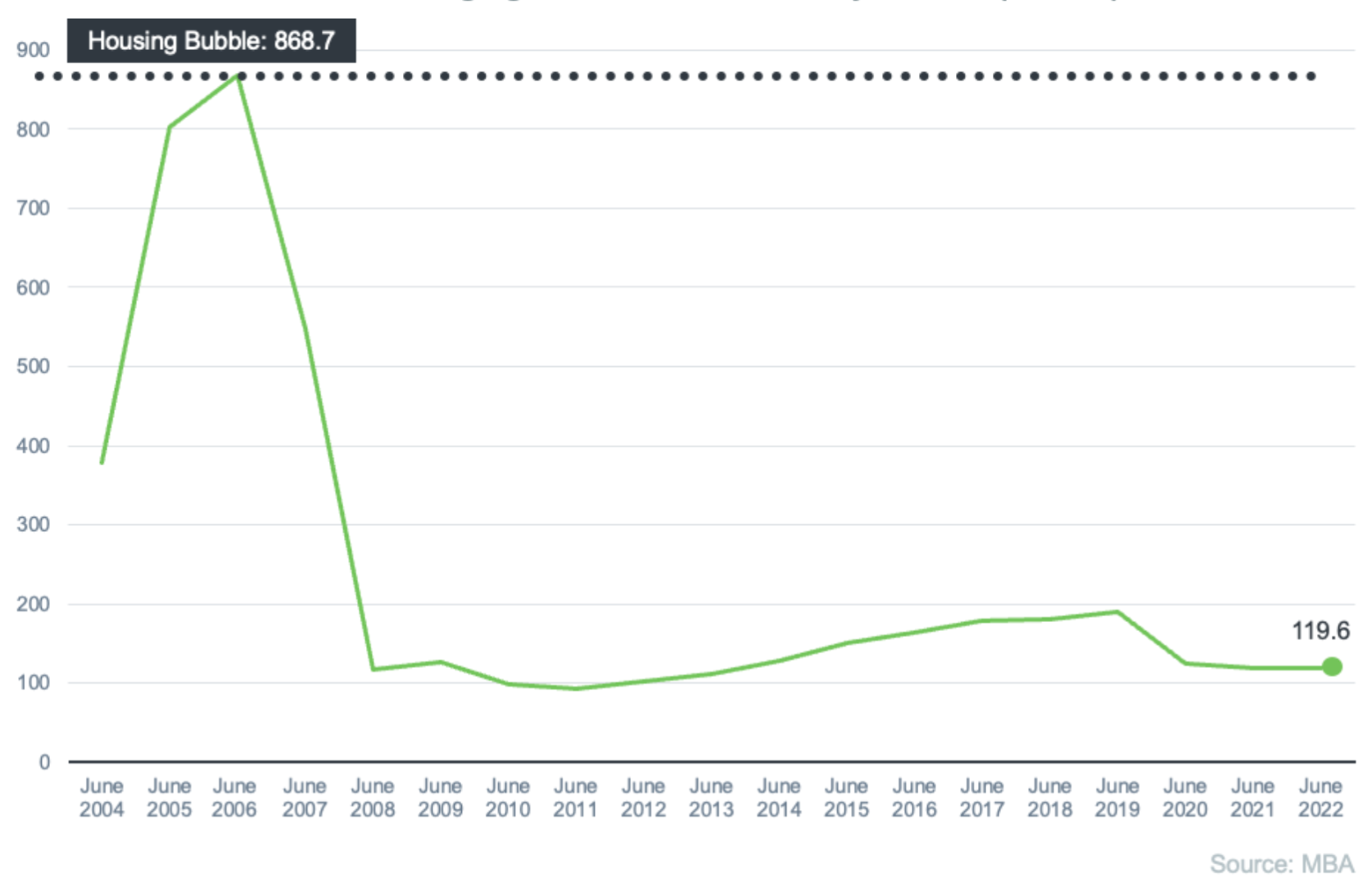

O volume de encerramento hipotecário não é nada parecido com o que era durante o crash

A diferença mais óbvia é o número de proprietários que estavam enfrentando o encerramento hipotecário após o estouro da bolha imobiliária. A atividade de execução hipotecária está em queda desde o crash porque os compradores hoje são mais qualificados e menos propensos a inadimplir em seus empréstimos. O gráfico abaixo usa dados da ATTOM Data Solutions para ajudar a contar a história:

Encerramentos Hipotecários (Foreclosure) Antes e Agora

Além disso, os proprietários de imóveis hoje são ricos em patrimônio, não aproveitados.

No período que antecedeu a bolha imobiliária, alguns proprietários estavam usando suas casas como caixas eletrônicos pessoais.

Muitos imediatamente retiraram seu patrimônio assim que ele se acumulou. Quando os valores das casas começaram a cair, alguns proprietários se viram em uma situação patrimonial negativa, onde o valor que eles deviam em sua hipoteca era maior que o valor de sua casa.

Algumas dessas famílias decidiram se afastar de suas casas, e isso levou a uma onda de anúncios de imóveis em dificuldades (execuções hipotecárias e vendas a descoberto), que foram vendidos com descontos consideráveis que reduziram o valor de outras casas na área.

Hoje, os preços subiram muito nos últimos anos, e isso deu aos proprietários de imóveis um patrimônio aumentoDe acordo com Black Knight:

“No total, os detentores de hipotecas ganharam US$ 2,8 trilhões em capital explorável nos últimos 12 meses – um aumento de 34% que equivale a mais de US$ 207.000 em capital disponível por mutuário. . . .”

Com o patrimônio médio da casa agora em US $ 207.000, os proprietários estão em uma posição completamente diferente desta vez.

Ficou com dúvidas?

Agora que explicamos para você que todos os sinais nos mostram que não estamos em uma bolha imobiliária, você já pode considerar investir em casas de férias em orlando. Para aproveitar todas as dicas que trouxemos para você e aprofundá-las ainda mais, você pode conversar diretamente com nossos agentes de relacionamento. Eles estão sempre dispostos a conversar com você para esclarecer dúvidas sobre investimentos na Flórida.

Neste texto nós abordamos o tema o comportamento do mercado imobiliário durante recessões por ser interessante para quem busca investir na Flórida. Se você deseja ler mais conteúdos como o que trouxemos neste artigo, é só ficar ligado aqui no nosso blog.

Gostou do artigo? Fique de olho no nosso blog! Querendo morar ou investir em imóveis na Flórida? Veja a lista de casas a venda na Flórida que selecionamos para você!

|

Getting your Trinity Audio player ready...

|

Leo Martins

Meu papel é criar um ambiente, para que pessoas se conectem à Negócios Imobiliários na Flórida