Comparing annual real estate metrics is challenging even in normal timesThis is due to the inherent fluctuation in the market, making comparisons often less meaningful or accurate. This challenge is magnified when unforeseen, high-impact events change circumstances.

The period of the last two years, aptly described as a 'unicorn' - a term that usually indicates something much desired but difficult or impossible to find - has profoundly transformed the real estate sector.

The pandemic has catapulted the demand for homeswhile people were looking for the security and comfort of a home office, preferably with a spacious backyard.

We've seen an influx of buyers looking for first or second homes, driven by mortgage rates that have hit historic lows.

The forbearance plan helped to virtually eliminate foreclosures, while home values reached unprecedented levels of appreciation. In short, we had a market that was strongly desired but difficult to reach. That's what characterized a truly 'unicorn' year.

Now, as things begin to return to normal, the 'unicorns' seem to have galloped away, leaving us with a more familiar and less fanciful real estate market.

Comparing today's market with those years doesn't make sense. Here are three examples:

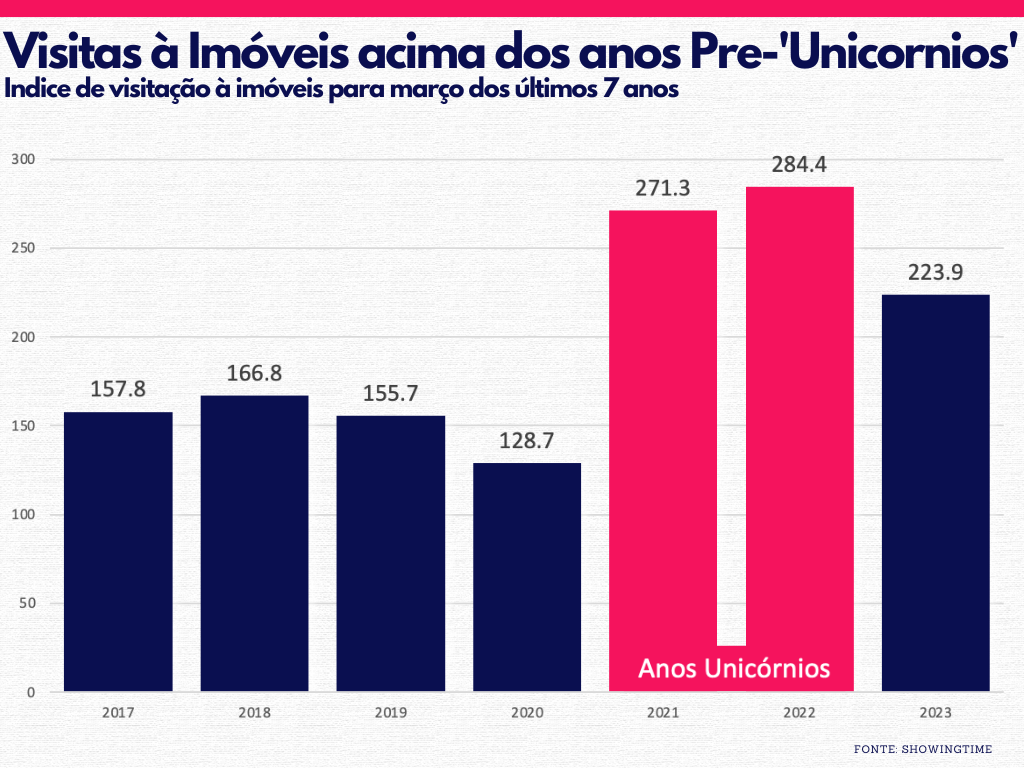

Buyer demand

Contrary to what the headlines might suggest, the real estate market is still buzzing with buyers. In the United States, more than 10,000 homes continue to be sold every day.

It's clear that buyer demand has decreased compared to the two 'unicorn' years.

However, when we look at the data provided by ShowingTime, and compare the current activity with the normal years (2017-2019)It is clear that buying activity remains robust, as can be seen in the chart below:

[ipt_fsqm_form id="8″]

Residential prices

It would be impossible to compare the increase in house prices today with what we have experienced in the last two exceptional years.

According to a report by Freddie Mac, both 2020 and 2021 saw historically high levels of real estate appreciation.

Below is a chart that also includes years considered more 'normal' for the real estate market, from 2017 to 2019:

It is noticeable that we are returning to a more conventional pace of property appreciation.

During the second half of 2022, we experienced several months of slight depreciation. However, as indicated by Fannie MaeThe market resumed a more traditional rate of appreciation in the first quarter of this year.

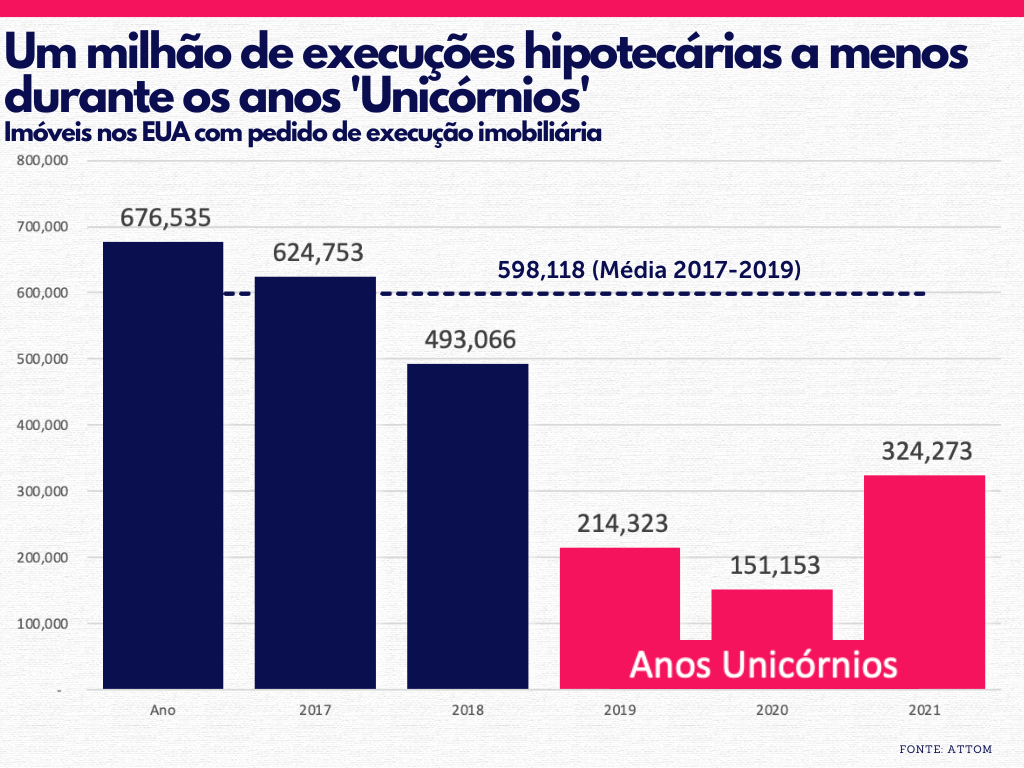

Mortgage Foreclosures

Recently, alarming headlines have highlighted percentage increases in foreclosure filings.

However, it is important to note that these percentages will inevitably rise from foreclosure rates that were at historically low levels.

Below is a graph based on information provided by ATOM, a respected source of real estate data:

With the end of the moratorium on foreclosures, an increase in numbers compared to the last three years is expected.

Unfortunately, every year some homeowners lose their homes to foreclosure, an event that is certainly painful for these families.

However, when we look at the current figures in a broader context, we can see that we are in fact returning to the 'normal' levels recorded between 2017 and 2019.

Summary

Any doubts?

Now that you've understood that it doesn't make sense to compare periods that are very non-standard, the famous unicorns. We can help you understand the behavior of the real estate market and consider investing in vacation homes in Orlando. To make the most of all the tips we've given you and go even deeper, you can talk directly to our relationship agents. They are always happy to talk to you to answer any questions you may have about investing in Florida.

Did you like the article? Keep an eye on our blog! Looking to live or invest in real estate in Florida? Check out the list of houses for sale in Florida that we've selected for you!

|

Getting your Trinity Audio player ready...

|

Leo Martins

My role is to create an environment for people to connect with Real Estate in Florida