Buying your first property is a milestone in anyone's life, a step that mixes emotion, achievements and plans for the future. For many first-time buyers in Florida, this moment represents more than just acquiring a property: is the realization of a dream built up over years of effort, planning and research.

But unlike in Brazil, the process of buying real estate in Florida follows its own rules and involves a completely different dynamic. From the offer and contract to financing and closing (closing), there are specific steps, standardized documents and legal responsibilities that require attention.

That's why having the support of experienced professionals makes all the difference. A good broker, together with a team specializing in financing and inspections, can transform a journey full of uncertainties into a safe and strategic experience, ensuring that every decision brings the buyer closer to the ideal home, within budget and with peace of mind.

In this guide, you'll discover what every first-time buyer in Florida needs to know before taking that big step: how to prepare, how to understand the market, what to expect from financing and what mistakes to avoid so that the dream of home ownership starts off right.

Contents

HideBefore starting to look for homes, it is essential for first-time buyers in Florida to prepare strategically. This initial step helps avoid frustration, saves time and ensures that each visit to a property has a real purpose within the buyer's budget and needs.

Define your objectives and priorities

The first step is to understand what you're really looking for in a house. Is it a main home, a second vacation home or a long-term investment? This answer completely changes the type of property, the location and even the most suitable type of financing. Making a list of priorities, such as number of bedrooms, region, distance from schools and lifestyle, helps to filter the options more clearly.

Organize your documentation

In the United States, the purchase process is much quicker when the buyer already has their documents in order. For foreigners, it is important to have a valid passport, proof of income, bank statements, credit history (if any) and, if applicable, an ITIN (Individual Taxpayer Identification Number). Having these items ready avoids delays and shows that you are serious about your application.

Set a realistic budget

In addition to the value of the property, it is essential to consider the additional costs involved in the purchase, such as home insurance, closing fees (closing costs), property tax (property tax) and maintenance. Assessing how much you can invest without compromising your cash flow is what allows you to make safe and realistic offers.

Get pre-approved for financing

For those who want to finance, the ideal is to obtain a pre-approval before the viewings even begin. This shows sellers that the buyer is qualified and speeds up the process when the ideal home comes up. This pre-approval also helps to set a value ceiling, avoiding wasting time on properties that are out of reach financially.

Count on experts from the start

Many first-time buyers in Florida believe they can start the search on their own, but an experienced buyer's agent at the start of the journey makes all the difference. This professional helps to understand the market, select suitable regions, review contracts and negotiate the best price with confidence.

In short, preparing well is what turns the dream of home ownership into a smooth and well-planned process. The preparation phase is the foundation for all future decisions and ensures that every step is taken with confidence.

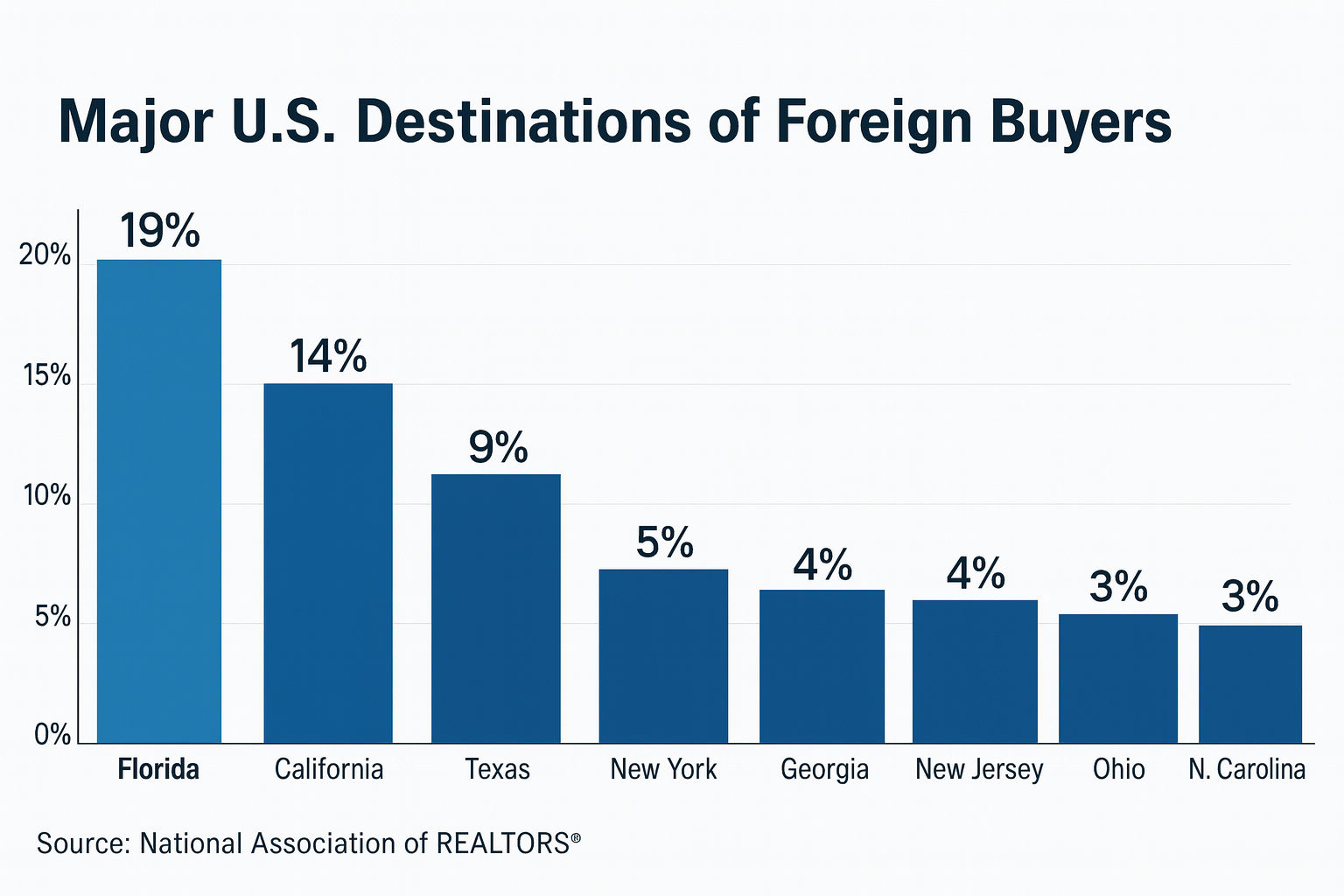

For first-time buyers in Florida, understanding how the local market works is one of the most important steps before closing a deal. Unlike other American states, Florida has unique characteristics that directly influence the price of real estate, the appreciation and even the liquidity of a property.

A diverse and dynamic market

Florida is one of the most sought-after states in the United States, both for those looking to live and for those looking to invest. The options range from houses in gated communities and homes in family areas to seasonal properties near the Disney parks.

While regions such as Orlando, Kissimmee and Davenport are known for attracting investors and families who want to take advantage of tourism, cities like Miami, Tampa and Naples have a strong residential and commercial appeal.

Difference between living and investing

One of the most common mistakes made by first-time buyers in Florida is to confuse the profile of those buying to live with those buying to invest. A residential property requires comfort, a strategic location and a community suited to one's lifestyle, while an investment property should be analyzed for profitability, average occupancy and potential for appreciation.

Regulated and transparent market

Another difference is that Florida's real estate market is highly regulated. All available properties are listed in the MLS system (Multiple Listing Service)This is an exclusive database of licensed brokers and agents. This guarantees total transparency in the price information, history and conditions of the house, as well as preventing duplicate or misleading listings.

Influence of seasonality

As a tourist destination, Florida has seasonal variations. The number of properties available, demand and even prices can change between summer and winter, when the flow of tourists and investors increases. For this reason, those who inform themselves and plan the right time to buy are more likely to get good deals.

In short, understanding the Florida real estate market is more than knowing prices and neighborhoods. It's about learning how it works, identifying opportunities and positioning yourself strategically, with professional support, to turn the dream of your first home into a smart and lasting investment.

Real estate financing is one of the most important stages in the buying process, especially for first-time buyers in Florida. Understanding how it works, what options are available and what documents are required is essential to making safe decisions and avoiding surprises along the way.

How financing works in Florida

In the United States, financing is known as mortgageand can be hired by American citizens, permanent residents and even foreigners with a valid visa or proven financial history.

Banks and financial institutions offer different types of loan, with terms that can vary from 15 to 30 years, and approval is based on criteria such as credit, income, financial stability and down payment.

Entry and conditions for foreigners

For those who do not have US residency or citizenship, banks usually require a down payment between 30% and 40% of the property value. This requirement is higher than for residents, but it is still an excellent opportunity for those who want to build wealth in the United States.

Interest rates can also vary depending on the buyer's profile and the type of property. That's why it's important to compare proposals and have a specialized consultant who understands the particularities of loans for foreigners.

Pre-approval: the first step

Before starting the visits, it is essential to obtain a pre-approval of financing. This document indicates the maximum amount that the buyer can finance and demonstrates to the seller that he is qualified for the purchase, which increases negotiating power.

In addition, pre-approval helps you focus on homes that really fit your budget, avoiding wasting time on properties that are out of your financial range.

Costs and fees involved

When financing a property in Florida, it is also important to consider the closing costsThese include notary fees, title insurance, property appraisal and legal fees. In general, these costs amount to 2% to 5% of the total purchase price and should be included in the planning.

Extra tip: think long-term

Buying your first property is an important step, and financing can be a great ally in achieving this goal. Evaluating the installments, the interest rate and the total term of the loan is essential to ensure that the purchase fits into the budget today and remains sustainable in the future.

With planning and professional guidance, real estate financing stops being an obstacle and becomes the key for first-time buyers in Florida to realize their dream of home ownership with security and peace of mind.

Among the most important decisions for first-time buyers in Florida is choosing a good buyer's agentIn the United States, the broker exclusively represents the buyer's interests throughout the purchase process. Unlike in many other countries, in the United States this figure plays an essential role in negotiating, ensuring legal certainty and guiding each stage of the transaction.

What a buyer's agent does

The buyer's agent is the professional who searches for properties compatible with the buyer's profile, schedules visits, analyzes market values, conducts the negotiation and accompanies the documentation until the purchase is closed.

It is a strategic ally that ensures that the buyer does not pay more than is fair and that all contractual clauses are respected.

This professional also helps the client to understand how the local market works, the type of property best suited to the purpose of the purchase and the areas with the greatest potential for appreciation.

What is the Buyer Broker Agreement?

To formalize this representation relationship, the Buyer Broker AgreementThis is a contract that establishes the duties and responsibilities of the broker and the buyer.

This agreement protects both parties and ensures that the broker acts in a dedicated manner, as he has a formal commitment to represent the client's interests.

It is worth noting that in most transactions, it's the seller who pays the buyer's agent commissionThis means that the buyer gets all this professional support at no extra cost.

Why this is so important

Many first-time buyers in Florida believe that they can deal directly with several brokers at the same time, but this can lead to confusion, duplicate information and even lost opportunities.

Having a single buyer's agent, with a formal agreement, guarantees access to all the properties available on the market (through the MLS, which we'll see in the next topic), as well as centralizing communication and ensuring that every detail is followed up by those who understand the process.

In short, the buyer's agent is the trusted partner who translates the American market, protects the buyer from common mistakes and transforms the buying journey into a smooth and well-guided experience.

One of the most common doubts among first-time buyers in Florida is whether they should talk to several brokers at the same time to increase their chances of finding the ideal property. The answer is simple: not necessary. Unlike in Brazil, where each real estate agency has its own portfolio, in the United States all available properties are listed in a single system called MLS - Multiple Listing Service.

What is MLS

The MLS is an official, integrated database that brings together practically all the properties available for sale in each region. This system is accessed exclusively by licensed brokers, guaranteeing total transparency on property information such as history, price, features, photos and listing status.

In other words, when a buyer is being assisted by an authorized broker, they already have access to all houses for sale on the market, regardless of the real estate company or the owner. This means that there's no risk of missing out on a good opportunity because you only have one agent.

Advantages of working with a single broker

Choose a single buyer's agent and maintaining constant communication has several advantages:

-

The professional better understands the buyer's profile and searches for properties more in line with their needs.

-

It avoids duplicate visits and cross-negotiations, which can jeopardize the progress of the purchase.

-

It makes it easier to follow the process, from the search to the signing of the contract.

-

It strengthens the relationship of trust, allowing the broker to negotiate more assertively on behalf of the buyer.

Transparency and security

As the MLS is regulated and updated daily, the buyer has the security of knowing that the information is reliable and that the advertised price reflects the real market value. What's more, any change in the property's status, such as a price reduction or a move to under contractautomatically appears in the system.

So working with a single broker doesn't limit your options, on the contrary, simplifies the process and guarantees full access to all market opportunities. This is one of the great advantages for first-time buyers in Florida, who can count on an organized, transparent and efficient system to achieve their dream home.

Buying your first property is a dream that arouses enthusiasm, but it can also bring moments of anxiety. It's natural for first-time buyers in Florida to face ups and downs along the way, especially when the ideal property seems to take a while to come along or when unforeseen circumstances arise in the negotiation or financing.

Understand that the process is part of the conquest

The search for the perfect home isn't always quick. Often, you'll need to visit several properties, adjust your budget or reconsider your priorities. This doesn't mean that something is wrong, but rather that you are getting closer to the right decision. Each visit helps you understand the market better and refine what really matters.

Avoid impulsive decisions

Excitement can lead buyers to act on impulse, especially when faced with a beautiful property or a good offer. However, it is important to remember that the purchasing process involves long-term financial commitments. Always evaluate calmly, talk to your broker and don't hesitate to ask for a second professional opinion.

Accept that the perfect property may not exist

It's common to idealize the "dream home", but in practice there will always be something that could be different. The secret lies in finding a balance between what is essential and what is adjustable. Small renovations, decoration and personalization can turn a good property into a perfect home over time.

Trust your team

An experienced buyer's agent knows how to guide the buyer through each stage, especially at times when expectations clash with the reality of the market. Trusting the professional and maintaining constant communication makes all the difference in overcoming frustrations and staying focused on the end goal.

Remember: it's an investment, not just an emotion

More than a personal achievement, buying a property is a strategic decision. First-time buyers in Florida should view this journey as a solid investment that requires patience, information and planning.

Peace of mind during the process comes from understanding that each challenge is temporary, and that the end result, having a home in the United States, is a lasting reward.

Among all the stages of buying a property, the survey and inspection are among the most important. They ensure that the buyer knows exactly what they are getting, avoiding unpleasant surprises after closing. For first-time buyers in Florida, understanding how this process works is essential to making a safe and informed decision.

What is home inspection?

A home inspection is a detailed technical assessment carried out by a licensed inspector, who analyzes the structural, electrical, plumbing and safety conditions of the house. Unlike a simple visit, this inspection is thorough and generates an official report with photos and observations on the condition of the property.

The inspector checks the roof, the HVAC system, the water heater, plumbing, foundation, windows, doors and even signs of infiltration, mold or pests. If problems are found, the buyer can negotiate repairs or discounts before closing.

Why inspection is essential

Even in new buildings, inspections are essential. Small construction or installation defects can become major headaches over time. In addition, a well-done inspection helps the buyer understand maintenance costs and possible future improvements.

In the case of condominiums or townhousesThe inspector also assesses common areas and items for which the association is responsible (HOA), ensuring that everything is in compliance.

How to choose a good inspector

Opting for a certified independent inspector is essential. The realtor can refer trusted professionals, but the buyer always has the right to choose the inspector they prefer. Before hiring, it is important to check the license and ask for examples of previous reports to assess the level of detail.

Quick checklist for buyers

-

Schedule the inspection as soon as the offer is accepted.

-

Be present, if possible, to accompany the evaluation.

-

Ask about any necessary repairs and approximate costs.

-

Review the entire report before making any final decisions.

The inspection is the time to confirm that the property really lives up to expectations and that the investment is safe. For first-time buyers in Florida, this stage represents the transition between dream and reality, the point at which the purchase ceases to be just an idea and becomes a conscious and solid choice.

Reaching the moment of move-inis one of the most exciting parts for first-time buyers in Florida. After all the waiting, the signing of contracts and the approval of financing, it's time to finally turn the property into a home. However, this is also a moment that requires attention to important details to avoid setbacks in the early days.

1. test all systems and installations

Before moving in completely, make sure everything is working properly. Test the sockets, taps, showers, water heater, air conditioning, stove and built-in appliances. If you notice any problems, contact the broker or the seller, depending on the terms of the contract.

2. Request the transfer of services

It's important to contact your local dealerships to make the transfer of energy, water, gas and internet bills to your name. Some cities also require the new owner to register with the county or neighborhood association (HOA).

3. Review the final documentation

Confirm that you have received all the closing documents, such as the title deed (property registration), the purchase contract and the final inspection report. These documents should be kept safe, as they will be needed for future transactions, renovations or financing.

4. Change the locks and check security

Even in new buildings, it is recommended to changing all the locks and, if possible, install a security system or cameras. This simple measure guarantees greater peace of mind and avoids the risk of old copies of keys still being in circulation.

5. Make an inventory and take photos

If the property comes furnished, take photos of all the items included in the purchase, such as furniture, appliances and utensils. This helps document the state of repair and avoids doubts in the future.

6. Schedule cleaning and possible repairs

A good clean before moving in makes all the difference, especially if the property has been closed for some time. You should also take the opportunity to make small repairs, such as painting, changing light fittings or adjusting cupboards, before bringing in the permanent furniture.

7. Get to know the neighborhood and local services

Take advantage of the first few days to familiarize yourself with your surroundings. Find out where the nearest supermarkets, pharmacies, schools, gas stations and hospitals are. This helps you feel part of the community and makes it easier to adapt to your new surroundings.

Moving into a new home is a time for celebration, but also for organization. Following this checklist helps first-time buyers in Florida ensure a smooth, safe transition full of good memories from day one.

Buying your first property is an exciting process, but it's also full of important decisions. Many first-time buyers in Florida end up making mistakes due to lack of information or getting carried away by the emotion of the moment. Knowing these pitfalls is the best way to avoid them and ensure a safe and strategic purchase.

1. Looking for houses before setting the budget

One of the most common mistakes is to start visits before understanding how much you can invest. This leads to frustration and wasted time. The ideal is to get a pre-approval of financing and calculate all the extra costs, such as insurance, fees and taxes, before starting the search.

2. Trying to deal with several brokers at the same time

Unlike Brazil, the American market works with the MLSThis is a system that brings together practically all the houses for sale. This means that there is no advantage in talking to several agents. On the contrary, it can lead to confusion and jeopardize negotiations. The ideal is to choose a reliable buyer's agent and stick with it from start to finish.

3. Impulse buying

The excitement of finding a beautiful or well-located house can lead to hasty decisions. It is essential to evaluate every detail calmly, especially the resale value, the neighborhood and the structural conditions. Buying based on appearance alone is a mistake that can cost you dearly later on.

4. Ignoring the inspection

Skip the home inspection to speed up the process is a serious mistake. Even if the property looks perfect, only a licensed inspector can identify hidden problems that affect the value and safety of the home. This step is essential to protect the investment.

5. Disregard future costs

In addition to the purchase price, it is important to consider recurring expenses such as property tax, maintenance, condominium (HOA fees) and home insurance. These amounts vary according to location and can have an impact on the monthly budget.

6. Not reviewing the contract carefully

The purchase contract in the United States follows specific rules and each clause has legal implications. That's why reviewing everything with your realtor or a specialized lawyer is essential to avoid surprises and ensure that your rights are protected.

7. Quitting in the middle of the process

Buying your first property can be challenging, especially for those who are dealing with the American system for the first time. However, maintaining patience and trusting the right team makes all the difference. Every step you take is a step closer to achieving your Florida home.

Avoiding these mistakes allows first-time buyers in Florida to have a positive, stress-free and safe experience. With professional guidance and planning, the dream of home ownership becomes a solid, well-structured reality.

1. Can foreigners buy real estate in Florida?

Yes, any foreigner can buy real estate in Florida, even if they don't have a US residence or visa. The process is legal and quite common, as long as the buyer has a valid passport and proven financial resources. The difference lies in the type of financing, which usually requires a larger down payment for non-residents.

2. Do I need an American visa to finance a property?

Not necessarily. Many banks offer mortgages for foreignersIf you are a resident or a citizen, you can apply for a mortgage, provided you can provide proof of income, bank history and appropriate documentation. However, the down payment and interest rates may be different from those offered to residents and citizens.

3. How long does it take to buy a property?

On average, the process takes 30 to 45 days after acceptance of the offer, taking into account the inspection, appraisal, financing approval and closing period. Cash buyers can complete the transaction even faster, in less than 20 days.

4. Do I need to be in the United States to buy?

No. The whole process can be done remotelywith electronic signatures, video conferences and full broker support. You can visit the property virtually and complete the purchase remotely with total legal certainty.

5. What are the additional costs on top of the house price?

In addition to the price of the property, it is important to include it in the budget:

-

Closing costs (closing fees, around 2% to 5% of the property value)

-

Home insurance

-

Property tax (annual property tax)

-

Condominium fee (HOA)if applicable

These costs vary according to the type and location of the property.

6. What happens if the property has problems after purchase?

That's why home inspection is so important. If the buyer detects faults before closing, they can negotiate repairs, rebates or even withdraw from the purchase. After completion, guarantees vary according to the contract and the type of property.

7. Can I rent out my property after buying it?

Yes, many first-time buyers in Florida purchase real estate for this purpose. However, it is important to check the condominium rules (HOA) and the local zoning lawsespecially if it's a short-term rental (short-term rental), common in areas close to Disney.

8. Does the broker charge the buyer anything?

No. In the United States, the broker's commission is paid by the seller and divided between the buyer's agent and the seller's agent. That's why having a buyer's agent does not generate extra costs and brings security to the process.

9. Is it possible to buy in the name of a company?

Yes. Many foreign investors choose to buy through a LLC (Limited Liability Company) to facilitate management and protect assets. This decision should be made with the advice of an accountant or lawyer specializing in international investments.

10. Is Florida a good place to invest for the long term?

No doubt about it. The state offers steady population growth, a booming economy, a pleasant climate and one of the most stable real estate markets in the US. For first-time buyers, Florida combines legal certainty, appreciation and great return potential.

Buying your first property in Florida is more than a financial investment, it's the realization of a dream that represents achievements and new beginnings. For first-time buyers in Florida, this journey may seem complex at first glance, but with information, planning and the right support, the process becomes clear and accessible.

The combination of a transparent market, the support of a buyer's agent and system security MLS makes sure that the buyer has full control of the stages and can make decisions with confidence. Every detail, from the pre-approval of the financing to the final inspection, is there to protect the buyer and ensure that the investment is solid and long-lasting.

More than finding a beautiful house, the real goal is to choose a property that brings quality of life, appreciation and peace of mind. And this is precisely where The Florida Lounge makes the difference, offering personalized guidance, local expertise and a network of specialists who accompany the buyer every step of the way.

If you're ready to take the first step and want to understand exactly how the process of buying real estate in Florida works, fill in the form below. Our team will contact you to offer a free consultation and help you make your dream of home ownership in the United States a reality.

Official and complementary sources

U.S. Department of Housing and Urban Development (HUD) - information on buying, financing and buyer's rights in the USA.

👉 https://www.hud.gov/buying

Consumer Financial Protection Bureau (CFPB) - official explanations about the mortgage process, closing costs and inspections.

👉 https://www.consumerfinance.gov/owning-a-home/

Florida Realtors Association - specific guidance on the Florida real estate market and up-to-date statistics.

👉 https://www.floridarealtors.org/

National Association of Realtors (NAR) - information on the role of the buyer's agent, the functioning of the MLS and brokerage practices in the USA.

👉 https://www.nar.realtor/

Office of Foreign Assets Control (OFAC) - legal guidelines for foreigners investing in real estate in the United States.

👉 https://ofac.treasury.gov/

Investopedia - Mortgage and Home Buying Guides - accessible explanations on financing, pre-approval and additional costs.

👉 https://www.investopedia.com/mortgage-4689743

Zillow Research - Florida Market Trends - data on valuation, property types and local market behavior.

👉 https://www.zillow.com/research/

Florida Department of Business and Professional Regulation (DBPR) - the agency responsible for licensing real estate brokers and inspectors in Florida.

👉 https://www.myfloridalicense.com/

U.S. Census Bureau - Florida Housing Data - official statistics on the state's residential growth and profile.

👉 https://www.census.gov/housing/

The Florida Lounge - practical and specialized knowledge in the purchase and investment of real estate in Florida by foreigners.

👉 https://www.thefloridalounge.com

|

Getting your Trinity Audio player ready...

|

Thalita Felisardo

Born on VHS, a Super Nintendo warrior and a lifelong theme park addict. Broadcaster, publicist and Orlando explorer by passion! I used to be Mickey's neighbor and I've made over 100 visits to Disney and Universal parks 🎢. Today I've swapped the enchanted castles for the rocky mountains of Canada, but my heart is still divided between the Northern Lights and the Magic Kingdom fireworks.

Related Posts

September 25, 2025

An updated overview of renting in Orlando in 2025

Construction cranes aren't the only things going up amid Orlando's boom. This...