The Federal Reserve has a simple manual for fighting inflation. It goes like this: continue to put upward pressure on interest rates until business and consumer spending across the economy weakens and inflation recedes

Historically speaking, the Fed's inflation-fighting manual always deals a particularly heavy blow to the US housing market. When it comes to real estate transactions, monthly payments are everything. And when mortgage rates rise - which happens as soon as the Fed goes after inflation - those payments increase for new borrowers. This explains why that mortgage rates have risen this spring, the real estate market has fallen into a real estate cooling.

But this housing correction can lose a little soon.

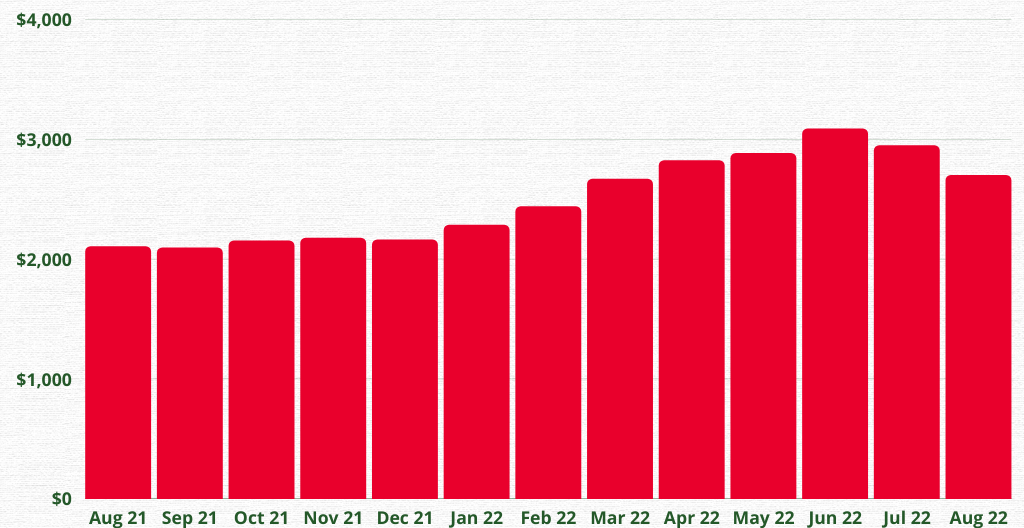

Last week, mortgage rates fell rapidly. On Tuesday, the average 30-year fixed mortgage rate was at 5.05%, down from June, when mortgage rates peaked at 6.28%. These falling mortgage rates provide immediate relief to home buyers who were in the corner. If a borrower in June took out a mortgage of $ 500,000 at a rate of 6.28%, he would pay $ 3.088 monthly in principal and interest. At a rate of 5,05%this payment would only be US$ 2.699. Over the 30-year loan, this represents a saving of US$ 140,000.

What's happening? As that the weakened economic data arrivesthe financial markets are pricing a recession in 2023. This is putting downward pressure on mortgage rates.

"The bond market is pricing in a high probability of recession next year, and that the slowdown will lead the Fed to reverse course and cut [federal funds] rates."

said Mark Zandi, chief economist at Moody's Analytics, Fortune.

Although the Fed does not directly set mortgage rates, their policies affect the way the financial markets price as much the yield on the 10-year Treasury mortgage rates.

In anticipation of an increase in the Federal Funds rate and monetary tightening, the financial markets are raising both the 10-year Treasury yield and mortgage rates.

In anticipation of a reduction in the federal funds rate and monetary easing, financial markets price in both the 10-year Treasury yield and mortgage rates. The latter is what we are seeing now in the financial markets.

The average 30-year fixed mortgage rate

As mortgage rates soared earlier this year, tens of millions of Americans have lost their eligibility for mortgages. However, as mortgage rates begin to fall, millions of Americans are regaining access to mortgages. That's why so many real estate professionals are rooting for lower mortgage rates: they should help increase home-buying activity.

While lower mortgage rates will undoubtedly prompt more secondary buyers to return to open houses, don't be so quick to write that we're at the end of the housing market correction.

[ipt_fsqm_form id="8″]

"The bottom line is that the recent decline in mortgage rates will help at the margin, but the housing market will remain under pressure with mortgage rates at 5% (fewer sales, slowing home price growth)."

wrote Bill McBride, author of the Economics blog Calculated Risk, in its Tuesday bulletin.

The reason? Even with the one percentage point drop in mortgage rates, housing affordability remains historically low.

"If we include the increase in house prices, payments increase by more than 50% year on year on the same house," writes McBride.

There's another reason why real estate bulls shouldn't get too confident: if recession fears - which are helping to drive down mortgage rates - are correct, this would cause some further weakening in the sector. If someone is afraid of losing their job, they won't enter the real estate market.

"While lower rates in themselves are positive for the real estate market, this is not the case when accompanied by a recession and rapidly rising unemployment."

Zandi told Fortune.

The monthly payment of principal and interest on a new mortgage of $ 500,000

The average 30-year fixed mortgage rate fell from 6.28% to 5.05% in the last two months

Where will mortgage rates go from here?

Bank of America researchers believe that there is a chance that the 10-year Treasury yield will fall from 2.7 to 2.0% over the next 12 months.

This could cause mortgage rates to fall to between 4% and 4.5%(The trajectory of mortgage rates correlates closely with the trajectory of the 10-year Treasury yield).

But there is one big wildcard: the Federal Reserve.

The Fed clearly wants to slow down the real estate market. O pandemic real estate boom which house prices have risen 42% e housing construction hit a 16-year high- is among the drivers of sky-high inflation. Reduced home sales and a decline in home construction should ease the housing supply in the US. We're already seeing it: house price adjustments are translating into reduced demand for everything from wood cabinets and windows.

But if mortgage rates fall too quickly, a recovering housing market could get in the way of the Fed's fight against inflation. If that happens, the Fed has more than enough monetary "firepower" to put pressure on mortgage rates once again.

"Whether we're technically in recession or not doesn't change my analysis. I'm focused on the inflation data... And so far, inflation continues to surprise us on the upside."

said Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, on CBS on Sunday.

"We are committed to reducing inflation. And we're going to do what we need to do."

Any doubts?

Now that you know how mortgage rates are behaving after the interest rate increases by the American central bank, you can consider investing in vacation homes in Orlando. To make the most of all the tips we've given you and go even deeper, you can talk directly to our relationship agents. They are always happy to talk to you to answer any questions you may have about investing in Florida.

In this article, we've covered the topic of the behavior of the real estate market during recessions because it's interesting for those looking to invest in Florida. If you would like to read more content like the one in this article, just stay tuned to our blog.

Did you like the article? Keep an eye on our blog! Looking to live or invest in real estate in Florida? Check out the list of houses for sale in Florida that we've selected for you!

|

Getting your Trinity Audio player ready...

|

Leo Martins

My role is to create an environment for people to connect with Real Estate in Florida